E-File Your Tax Return with RapidTax and Receive your Refund Within 21 Days!

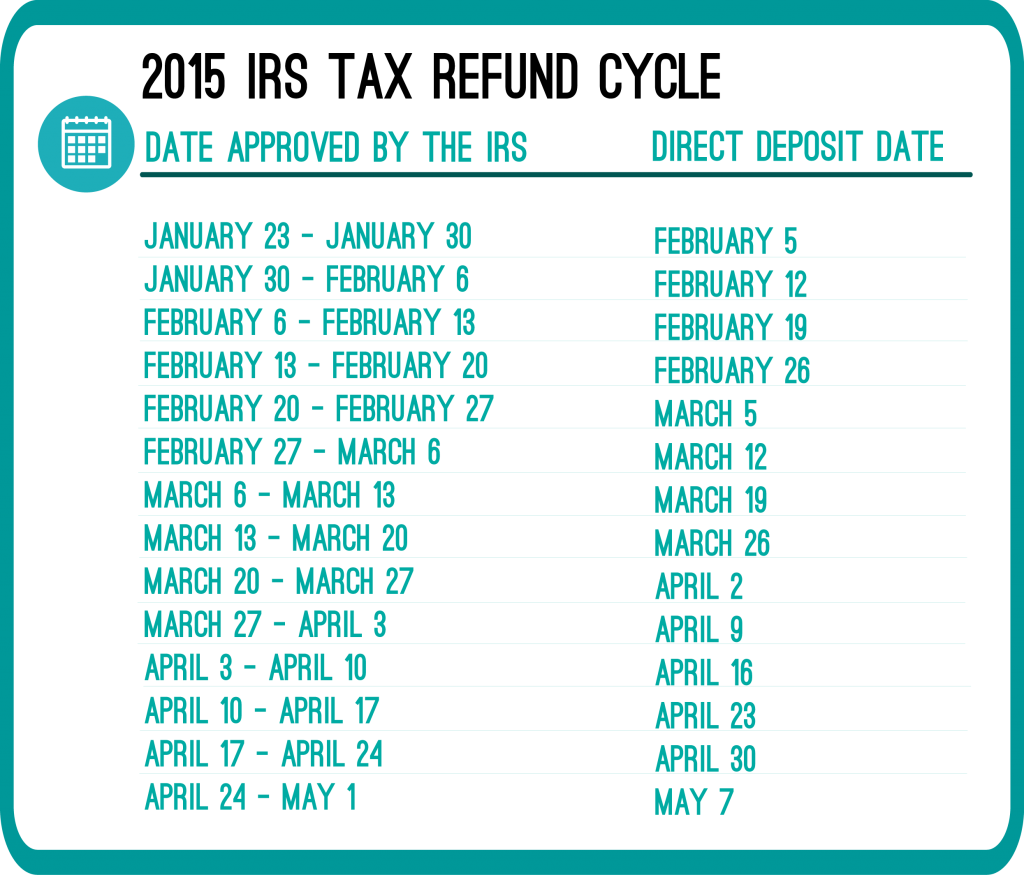

In the past, the IRS released a refund cycle chart. This chart allowed tax filers to know exactly when they would receive their tax refund. Sounds helpful, right?

Unfortunately, the IRS no longer posts the refund cycle chart. Luckily, there are charts out there which give a pretty accurate prediction on when you’ll get your refund.

You may want to know how long it will take to receive your tax refund once you file your 2014 tax return. Luckily, we’ve provided a refund cycle chart below.

Keep in mind however, these dates are NOT definite. They are only expected dates, based off of previous year trends.

Track Your Refund on the IRS Site

Once your 2014 tax return is e-filed, you’ll be able to track your tax refund using the IRS “Where’s My Refund?” tool. The site will give you status update on the whereabouts of your tax refund after you’ve entered the following information;

- social security number

- filing status

- refund amount

You’ll also be happy to hear the RapidTax team is available to answer any refund or tax return questions you may have before, during or after filing your tax return!

Get Ready for the 2015 Tax Season

Tax Day (the IRS due date for 2014 tax returns) was April 15th. If you’d like to receive your refund sooner rather than later, it’s best to e-file your 2014 taxes as soon as possible with RapidTax!

So what are you waiting for? Create an account and get your 2014 Taxes out of the way today!

Photo via Chris Potter on Flickr

question I did my taxes on the 21st in the 21st it said it was accepted but when I go to check where’s my refund nothing shows up could that mean something is wrong?

Hi Corey,

The Where’s My Refund tool tends to be a bit delayed with updates.

When you check it now does it say something different? I ask because I’ve been checking mine all week and I’m waiting for it to say it was approved.

I was wondering the same thing, I filed on jan 21 and accepted the 21… It is now feb 5 and nothing. I check “where’s my refund” and it still says processing… I do have an educational credit on my taxes, and had to pay a penalty for not having insurance… Would these cause a delay?? People who have filed after me have already got there’s. I just don’t know why I haven’t received mine yet.

Hi Shauna,

The IRS has announced that it is experiencing high traffic on Where’s My Refund as more tax returns come in. The heavy volume of refund inquiries means that the IRS anticipates both the “Where’s My Refund?” tool and the refund feature on the IRS2go phone app will have limited availability during busier periods.

Due to the large number of inquiries and to avoid service disruptions, the IRS strongly urges taxpayers to only check on their refunds once a day. IRS systems are only updated once a day, usually overnight, and the same information is available whether on the internet, IRS2go smartphone app or on IRS toll-free lines. While “Where’s My Refund” is updated nightly, your account will not change that frequently.

Question here. I filed on the 20th and on the 21st it said it was accepted. When should I expect a refund as it does not show my date filed in the tax refund cycle.? Thanks.

Hi Valerie,

As stated in the article, you may want to check the “Where’s My Refund” tool on the IRS website. This will give you an estimated date of when to expect your refund.

Hi i filed on jan 18th and it says my return still wasnt excepted by irs yet? And i still.didnt receive the email? Is there something wrong with it??

Hi Mandy,

Since the official start of the tax season was January 2oth, there are a high volume of returns to be processed. You may want to allow for a few extra business days to receive an accepted status on your return.

I figured that issue out and its been saying for over a wk now that the irs site that it been recieved but not approved yet?

I got a text message saying my taxes were accepted on Jan. 20 at 10:47 but when I tried to track it but nothing can be found. Is it too early?

Hi Kiara,

I suggest checking back daily until a status is received.

Today Jan 20 and the irs received my return at 8pm. So far a good sign.