E-File Your Tax Return with RapidTax and Receive your Refund Within 21 Days!

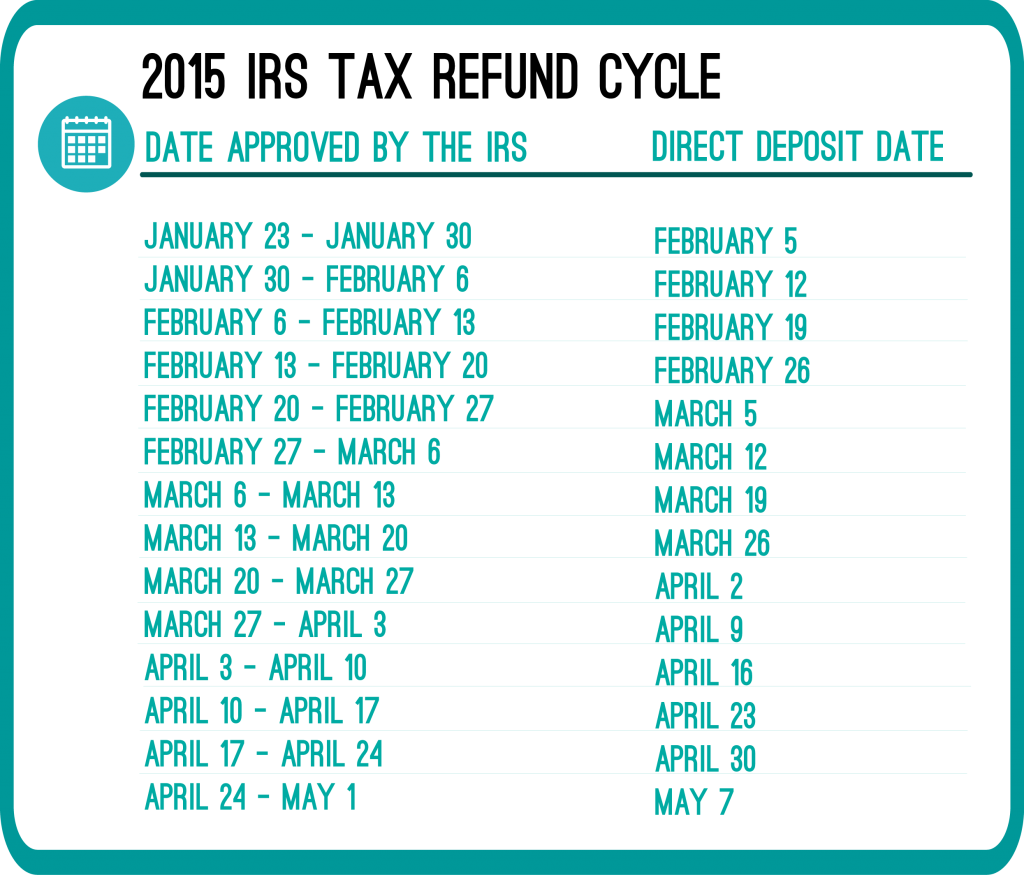

In the past, the IRS released a refund cycle chart. This chart allowed tax filers to know exactly when they would receive their tax refund. Sounds helpful, right?

Unfortunately, the IRS no longer posts the refund cycle chart. Luckily, there are charts out there which give a pretty accurate prediction on when you’ll get your refund.

You may want to know how long it will take to receive your tax refund once you file your 2014 tax return. Luckily, we’ve provided a refund cycle chart below.

Keep in mind however, these dates are NOT definite. They are only expected dates, based off of previous year trends.

Track Your Refund on the IRS Site

Once your 2014 tax return is e-filed, you’ll be able to track your tax refund using the IRS “Where’s My Refund?” tool. The site will give you status update on the whereabouts of your tax refund after you’ve entered the following information;

- social security number

- filing status

- refund amount

You’ll also be happy to hear the RapidTax team is available to answer any refund or tax return questions you may have before, during or after filing your tax return!

Get Ready for the 2015 Tax Season

Tax Day (the IRS due date for 2014 tax returns) was April 15th. If you’d like to receive your refund sooner rather than later, it’s best to e-file your 2014 taxes as soon as possible with RapidTax!

So what are you waiting for? Create an account and get your 2014 Taxes out of the way today!

Photo via Chris Potter on Flickr

I filed 1/25 and it’s still processing. No transcript no updates. They can’t say obamacare isn’t to blame. Have you guys heard anything new?

Hi Nicole,

The IRS has announced that it is experiencing high traffic on Where’s My Refund as more tax returns come in. The heavy volume of refund inquiries means that the IRS anticipates both the “Where’s My Refund?” tool and the refund feature on the IRS2go phone app will have limited availability during busier periods.

Due to the large number of inquiries and to avoid service disruptions, the IRS strongly urges taxpayers to only check on their refunds once a day. IRS systems are only updated once a day, usually overnight, and the same information is available whether on the internet, IRS2go smartphone app or on IRS toll-free lines. While “Where’s My Refund” is updated nightly, your account will not change that frequently.

We filed on the 31 it was accepted on the 1st as of the 8th it has, nt been approved any advise

Hi Ruben,

The IRS has announced that it is experiencing high traffic on Where’s My Refund as more tax returns come in. The heavy volume of refund inquiries means that the IRS anticipates both the “Where’s My Refund?” tool and the refund feature on the IRS2go phone app will have limited availability during busier periods.

Due to the large number of inquiries and to avoid service disruptions, the IRS strongly urges taxpayers to only check on their refunds once a day. IRS systems are only updated once a day, usually overnight, and the same information is available whether on the internet, IRS2go smartphone app or on IRS toll-free lines. While “Where’s My Refund” is updated nightly, your account will not change that frequently.

Filed 1/30 received dd for 2/11 to deposit direct deposit.

Hi everyone!

I have a question that seems to not be able to get answers. Please help!

My husband and I both owe taxes to the IRS. This year we filed married filing jointly. The amount of refund that we will be receiving will be enough to cover what I owe in taxes. So the remaining amount would it be refunded to me or would the IRS take it and put it towards his balance? Even though my name is first or should I say head of household on the income taxes. Does this make sense? Can anyone help me answer this? Thank you!

Hi Cindy,

If you are filing a joint return, then both spouses are responsible for the total income amount and the amount owed. If you are worried about being responsible for your husband’s amount owed, I suggest filing as “married filing separately”. This option still reports your and your spouse as married but you will each be responsible for your own income and amount owed.

Filed and received on Feb 2nd and approved today DDD Feb 10