E-File Your Tax Return with RapidTax and Receive your Refund Within 21 Days!

In the past, the IRS released a refund cycle chart. This chart allowed tax filers to know exactly when they would receive their tax refund. Sounds helpful, right?

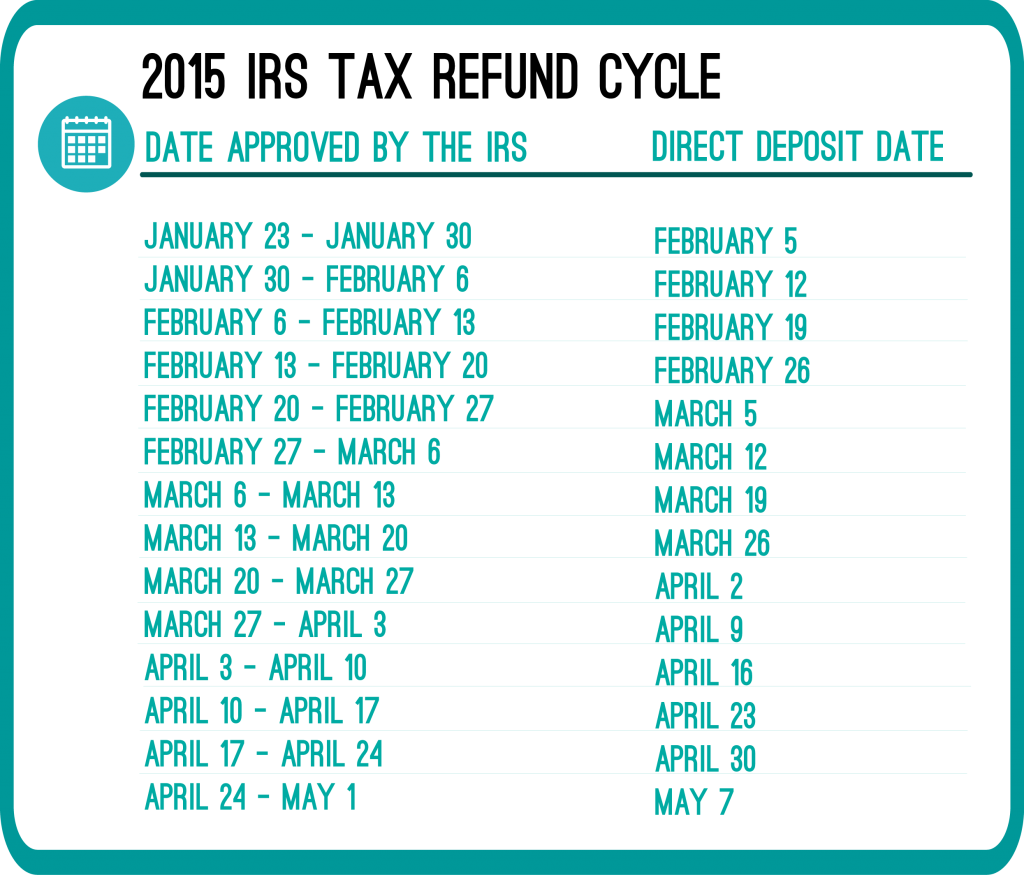

Unfortunately, the IRS no longer posts the refund cycle chart. Luckily, there are charts out there which give a pretty accurate prediction on when you’ll get your refund.

You may want to know how long it will take to receive your tax refund once you file your 2014 tax return. Luckily, we’ve provided a refund cycle chart below.

Keep in mind however, these dates are NOT definite. They are only expected dates, based off of previous year trends.

Track Your Refund on the IRS Site

Once your 2014 tax return is e-filed, you’ll be able to track your tax refund using the IRS “Where’s My Refund?” tool. The site will give you status update on the whereabouts of your tax refund after you’ve entered the following information;

- social security number

- filing status

- refund amount

You’ll also be happy to hear the RapidTax team is available to answer any refund or tax return questions you may have before, during or after filing your tax return!

Get Ready for the 2015 Tax Season

Tax Day (the IRS due date for 2014 tax returns) was April 15th. If you’d like to receive your refund sooner rather than later, it’s best to e-file your 2014 taxes as soon as possible with RapidTax!

So what are you waiting for? Create an account and get your 2014 Taxes out of the way today!

Photo via Chris Potter on Flickr

I filed on the 20th it was received the 20th and the IRS where a my refund still says received no change and no date I did direct deposit when should I expect to see my refund

Hi Victoria,

You should have received your refund around February 5th. Keep in mind that these dates are approximate based on prior year trends.

Hi,

I filed my taxes and they were accepted on January 26th. I check the status on the WMR tool on the irs.gov website and it still has not been approved. When can I expect my refund? I chose to have my funds DD. I know people who filed the same time as myself and have received a DD date for they’re refund already.

Hi Shanea,

Once the IRS approves your return, then you will base the date off of that date. However please keep in mind that these dates are only approximate based on prior year trends.

I did my taxes on the 29th. It was accepted on the same day. According to the chart it would be the fifth. Correct?

Hi Yvette,

That is correct. However, please keep in mind that these dates are only approximate based on prior year trends.

I filed my taxes on the 16th, through a tax service. When I go to where’s my refund it keeps telling me it’s being processed, and now it is stating that a date will be provided. But no date yet. I am also receiving a paper check, does that have something to do with how long it is taking?

Hi Kayp,

Choosing to receive a check instead of direct deposit will add time to when you receive your refund in the mail.

Did my taxes on jan 29 and it was excepted a few hours later but as if today it hasn’t been approved. When should I get my direct deposit

Hi Stephanie,

As stated in the article, you can expect your refund around February 5th but please keep in mind that these dates are estimated based on prior year trends.