E-File Your Tax Return with RapidTax and Receive your Refund Within 21 Days!

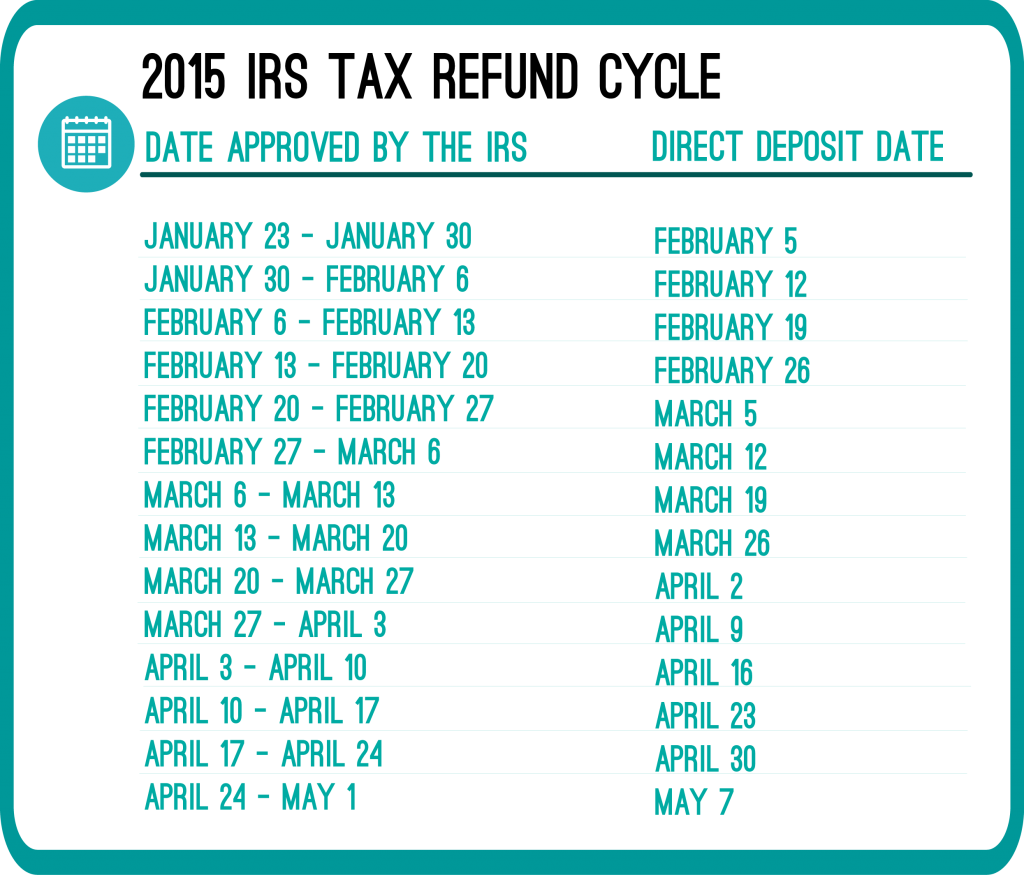

In the past, the IRS released a refund cycle chart. This chart allowed tax filers to know exactly when they would receive their tax refund. Sounds helpful, right?

Unfortunately, the IRS no longer posts the refund cycle chart. Luckily, there are charts out there which give a pretty accurate prediction on when you’ll get your refund.

You may want to know how long it will take to receive your tax refund once you file your 2014 tax return. Luckily, we’ve provided a refund cycle chart below.

Keep in mind however, these dates are NOT definite. They are only expected dates, based off of previous year trends.

Track Your Refund on the IRS Site

Once your 2014 tax return is e-filed, you’ll be able to track your tax refund using the IRS “Where’s My Refund?” tool. The site will give you status update on the whereabouts of your tax refund after you’ve entered the following information;

- social security number

- filing status

- refund amount

You’ll also be happy to hear the RapidTax team is available to answer any refund or tax return questions you may have before, during or after filing your tax return!

Get Ready for the 2015 Tax Season

Tax Day (the IRS due date for 2014 tax returns) was April 15th. If you’d like to receive your refund sooner rather than later, it’s best to e-file your 2014 taxes as soon as possible with RapidTax!

So what are you waiting for? Create an account and get your 2014 Taxes out of the way today!

Photo via Chris Potter on Flickr

My fed taxes were part of the early acceptance test group and they were accepted on Jan 12th so would deposit be any sooner?

Hi Tammy,

As stated in the article, I suggest taking a look at the “Where’s my Refund” tool on the IRS website.

Hi my refund was accepted 1/16/15. Does that mean I will be getting my taxes early

Hi Toya,

As stated in the article, I would suggest checking the “Where’s my Refund” tool on the IRS website.

Hi I have a ? I filled on the 14 so its saying pending they don’t start excepting taxes till the 20th now what will happen if someone tried to fill me and my child would it reject it

Hi Rita,

I suggest taking a look at another article on our blog that with answer any questions you have about two people claiming one dependent.

If someone does then you should call IRS And give the name of the person so they have a heads up because of it comes back that both you files the same child then that can mean criminal federal charges. Please please make sure you let the IRS know.

I got a very welcome surprise on January 12, 2015… My taxes were accepted by the IRS! My question is when could I expect my refund? Has anyone gotten theirs already? Or anyone have any news about it? Thanks for your help

Hi Heather,

I suggest taking a look at the IRS’ Where’s My Refund tool.

According to the refund cycle chart the deposits should be on 2/5/15 and paper checks would mail 2/6/15.

Have you received your refund yet? Mine was also accepted on the 12th

i thought they accepting them on 20 th of jan

No 0% has gotten theirs back yet, the first drop is supposed to happen by February 5th.

Not true I got mine on Jan 30th

first refunds went out on the 30th of jan 2015

My fiancé filed january 20th and got his back on the 28th

On what day could you file your homestead credit

Hi Kimberly,

I suggest checking with the state you are referring to for more information.