Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

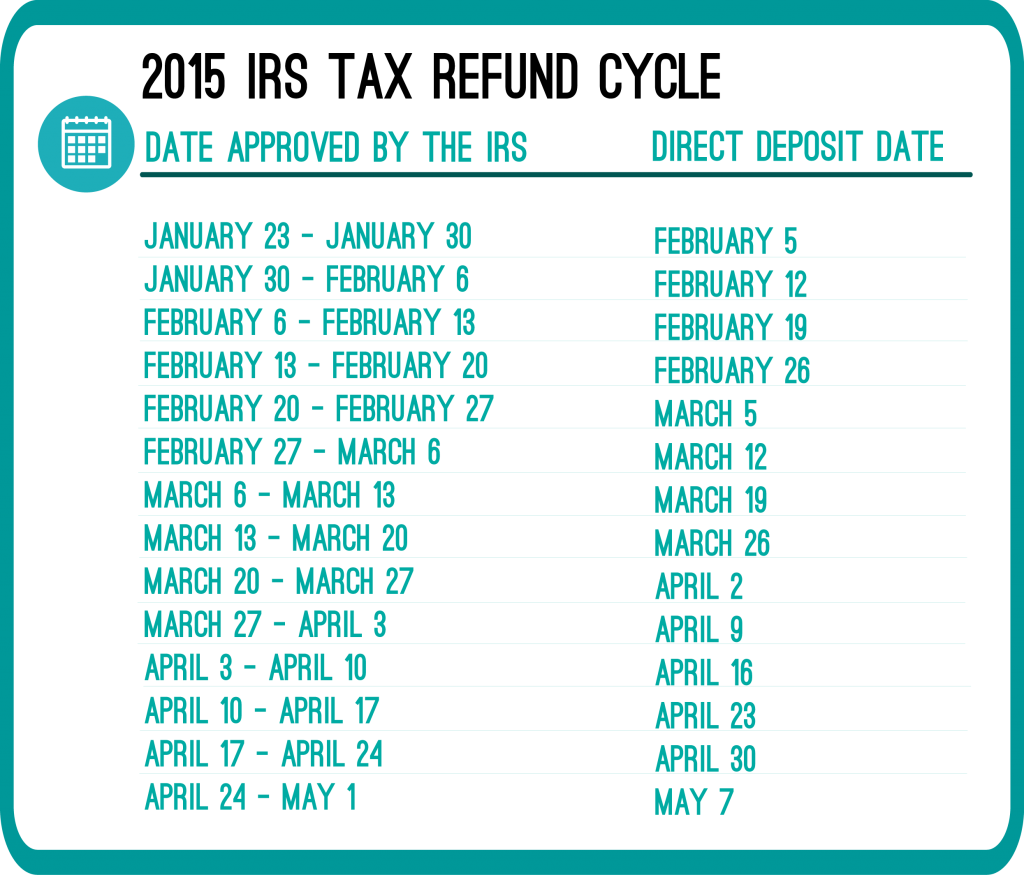

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

I filed my taxes on 01/30/14. Federal was accepted on 1/31/14 and state was accepted on 2/4/14. I already have a DD date for State for 2/12/14 but do not have an approval for my federal as of yet? Is this normal?

Hi Beth,

Yes, that’s normal and sometimes happen. Make sure you check back to see the status of your federal return, to make sure it is approved.

I checked my status again today and still just showing as “Received” for Federal.

I was accepted 01/31, status has continued to be processing as of today, 02/12. Getting very frustrated.

I was accepted 01/29/14 and aproved 02/15/14 with a ddd 02/20/14….

I got my fed refund back on the 2/10 but didn’t here about my state yet what does that ran???

Hi Kim,

Some states can take longer than others or longer than the IRS to process refunds. If your state allows you to check the status of your return on their website, I would suggest doing that. You can simply Google search it. For example, search “Where’s My Refund for State of New York” and obviously just substitute your state in. Be sure the website ends in .gov. (That way you know it is safe).

Best of luck!

I filed and was approved on jan 31 irs I should have my refund by yhe 10 of feb

Hi Kristyl,

That’s awesome news!

I filled my taxes on the 24 Jan n i got a date saying my check will b deposit on the 6 Feb. So what do that mean

Hi Keya,

It means just that, your tax refund will be put into your account on February 6th.

I too have received a DDD of 02/06/14 and have not received anything as of yet nor has my financial institution. When can I expect my refund or should I be worried? My tax return was accepted on 1/29/14 with a DDD of 2/6.

Hi there,

I would check with the company you filed your tax with to make sure they have the correct banking information (if direct deposited) if you do not get it by the beginning of next week. Sometimes, it takes a few days for the deposit to process through the banking account and appear.

I filed jan 14 when will i get my return??

Hi Candace,

It usually take the IRS up to 21 days to process a refund.

We filed on the 15th of January. Our federal return was accepted on 1/28/14 and our state was accepted on 1/31/14 ( at about 10:30 pm). Neither state or federal has any updates other than it is being processed. The irs.gov site also says they process most refunds in LESS than 21 days. The longest I have ever waited from the accepted date is 8 days and the shortest was less than 48 hours.