Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

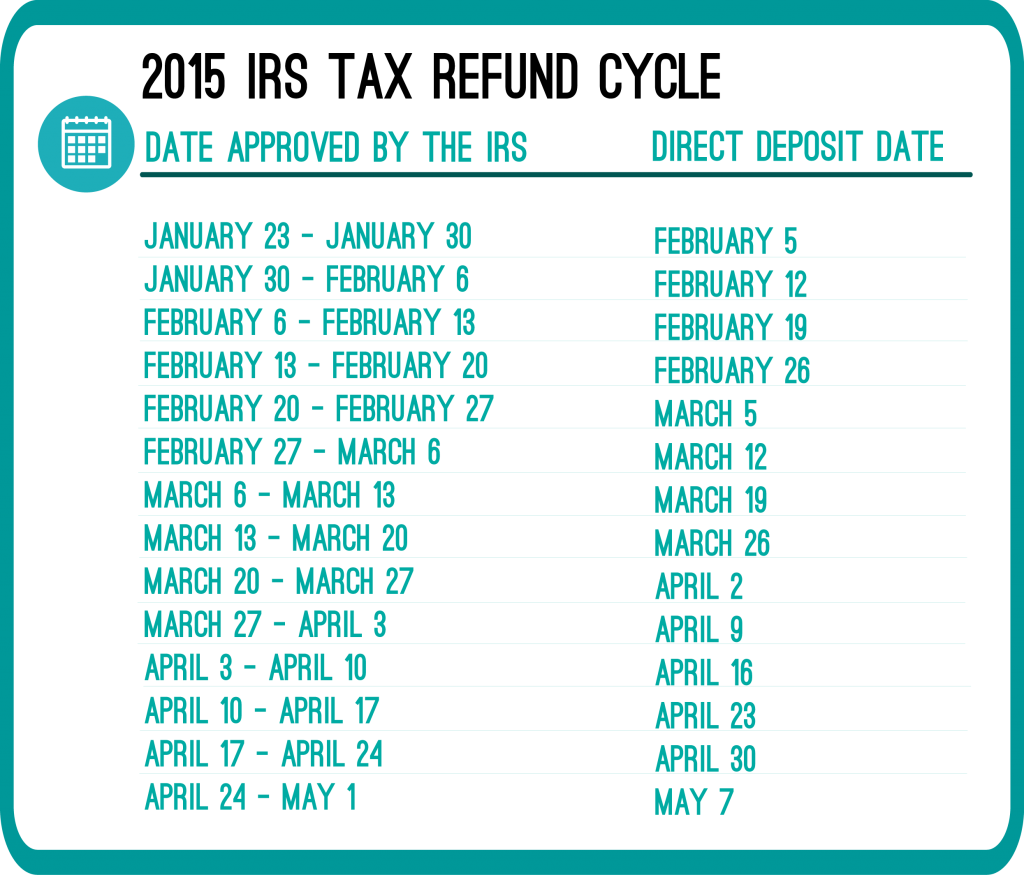

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

my taxes was accepted on Jan 26 but still saying still processing my bars disappeared I called my tax preparer they said its nothing wrong should I be worried

Hi Kelly,

The IRS has announced that it is experiencing high traffic on Where’s My Refund as more tax returns come in. The heavy volume of refund inquiries means that the IRS anticipates both the “Where’s My Refund?” tool and the refund feature on the IRS2go phone app will have limited availability during busier periods.

Due to the large number of inquiries and to avoid service disruptions, the IRS strongly urges taxpayers to only check on their refunds once a day. IRS systems are only updated once a day, usually overnight, and the same information is available whether on the internet, IRS2go smartphone app or on IRS toll-free lines. While “Where’s My Refund” is updated nightly, your account will not change that frequently.

I e-filed, was accepted 2-4-15 was accepted and says direct deposit date is 2-11-15 how accurate are the direct deposit dates?

Hi Leann,

The date provided by the IRS is an approximate date as to when you can expect your refund. I suggest allowing 2-3 business days of leeway.

When will I revive my refund if it was mailed out on the 6th of feb?

Hi Tautyanna,

The IRS mails all refunds via USPS unless otherwise specified so I would allow 3-4 business days to receive your check.

I filled February 7 on a saturday and i went to check my refund status and it keeps saying your information was entered incorrectly but i enterd in exactly what my turbo tax told me to .. What does that mean

Hi Alexis,

I suggest contacting Turbo Tax as it may be a mistake on their part if you are sure that you entered the information correctly.

Hi file on the 17 of January but it got rejected because I had a pin on ss but I redid my return on the 20 and it got accepted I’m still waiting for a status updates should I be worry

Hi Marteka,

The IRS has announced that it is experiencing high traffic on Where’s My Refund as more tax returns come in. The heavy volume of refund inquiries means that the IRS anticipates both the “Where’s My Refund?” tool and the refund feature on the IRS2go phone app will have limited availability during busier periods.

Due to the large number of inquiries and to avoid service disruptions, the IRS strongly urges taxpayers to only check on their refunds once a day. IRS systems are only updated once a day, usually overnight, and the same information is available whether on the internet, IRS2go smartphone app or on IRS toll-free lines. While “Where’s My Refund” is updated nightly, your account will not change that frequently.