Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

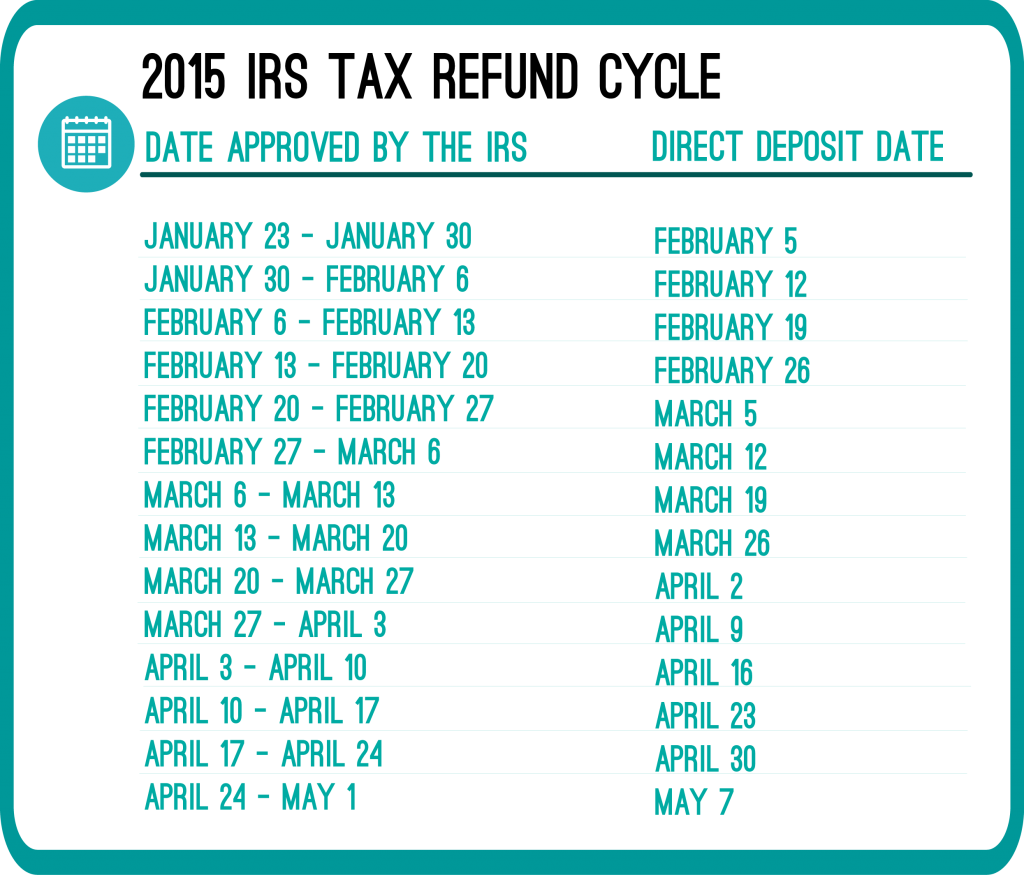

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

I filed on the 27th. Mine says refund is still being processed but it doesn’t have the status bar with received approved and sent. Should I be worried about that? And my friend filed the 24th of January and has already received hers. Is there anything you can do to check this out for me and see where I stand.

Hi Pamela,

Filing on January 24th would give you an estimated date to receive your refund around February 5th. If you have not yet received your refund, I suggest contacting your tax preparer directly.

Hi,

I had filed early. It was accepted 1/20/15, but I didn’t get an approval yet. I filed single and did it through H & R Block online. Have you heard any being held up? I see a lot of people are getitng theirs today 1/30/15. not me though.

Thanks,

Kevin

Hi Kevin,

Please keep in mind that the IRS received an extremely high volume of returns on January 20th, considering that was the official start date of the tax season. This may cause a slight lag in processing. I suggest checking the “Where’s My Refund” tool daily until you receive an update.

I’m in second line it says it should go to my bank by Jan 30 do that mean I’ll get it today or tomorrow it say if not received by then wait to Feb 4 an nothing still then Call my bank but I got the h&r block card

Hi Kristin,

January 30th is your estimated direct deposit date. In regards to the H&R Block Card, you will need to contact them directly to see how that will work.

I filed on the 2nd of Feb, it said accepted and processing, it comes quicker on a netspend card?

I had e-filed on the 22nd and accepted the 22nd. It shows processing and tax topic 152. I’ve notices a lot of people who has done taxes the same time or after being approved already. Should I be concerned? I also check and I don’t have any offset. Any help will be greatly appreciated! Thanks 🙂

Hi Felisha,

Based on the general refund cycle, you should receive your refund (via direct deposit) by February 5th. You don’t have anything to worry about as of yet.

Good morning. I filed my taxes, along with my daughters taxes the same day. Different filing statuses. Mine was now approved, but hers is still being processed. How can that be when they were literally submitted within minutes of each other?

Thank you!

Hi Rhonda,

This will depend on the tax preparer you chose. Once the returns are submitted, it is possible that they are then funneled through to different lists depending on certain factors such as filing status, state, income, etc. It really depends on the tax preparer.