Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

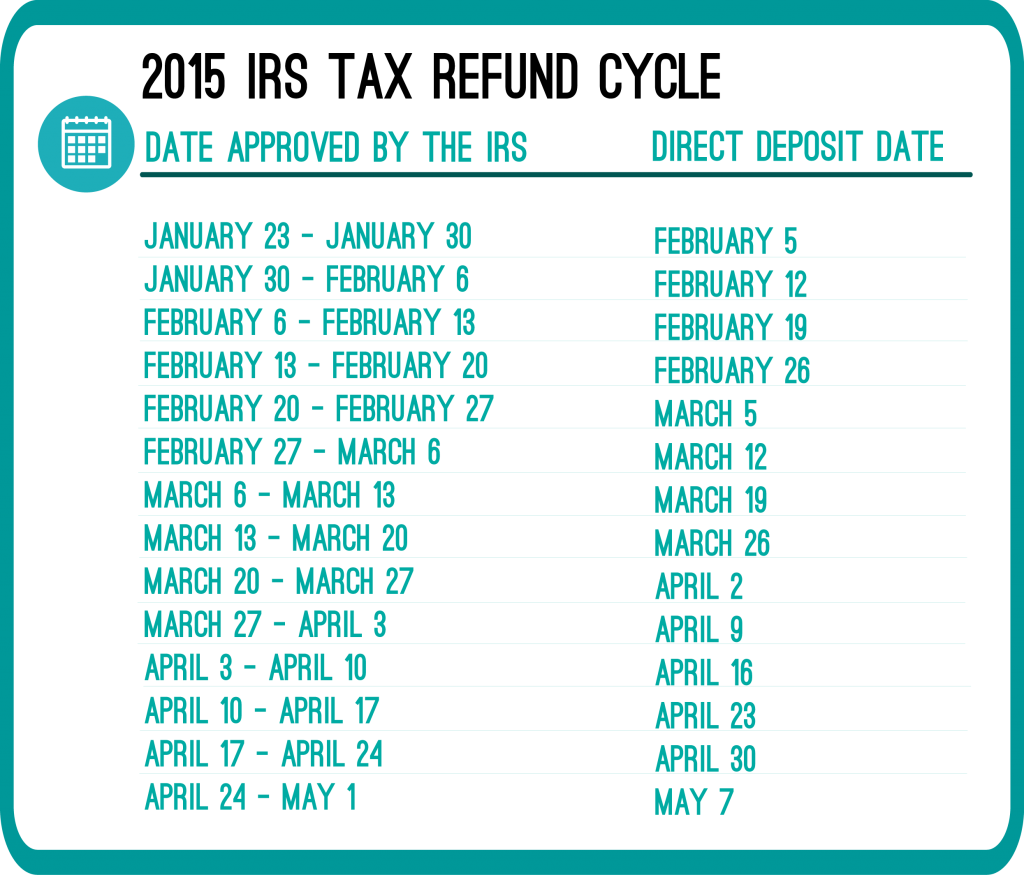

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

Hello I filed my taxes two weeks ago an today the 20th jan 2015…. I just wont to no when do u think

I will receive my refund back paper check an I filed with American tax place. ..

Hi Julie,

As stated in the article, I suggest checking the “Where’s My Refund” tool on the IRS website.

I e filed my tax return on january 6, 2015 at that time the program I was using said IRS would not start accepting returns until January 20, 2015. I got an e mail saying the IRS had accepted my return on January 13, 2015. Does anyone know if they were doing a test batch or if they started accepting earlier?

Hi Syd,

According to the IRS, the start date of tax season this year is January 20th.

hello i filed my taxes Feb 2014 and it is now SEPT 2014 and i have not yet received not a notice or nothing about my refund. when i check my ststus it says ‘still being processed’ now it has been processing for some time now as you can see. would u happen to know what the hold up is?

Hi Lucy,

Since you have used the IRS “Where’s My Refund” tool already, the next step would be to contact the IRS directly. There are a few reasons why your refund may have been delayed. They may need additional information from you among other things.

this is for my sister she filed for taxes this year and she was supposed to get her taxes back on schedule then the IRS tried to take her money for her husbands kids for child suppose, she had to go through a process to make it so her money stayed with her and her kids, since then her and her husband are no longer together and she keeps getting the run around about her getting her taxes back they keep telling her wait till this day, and when the day comes the tell her to wait for another day this has happened about 8 times so far and they keep telling her to wait longer and longer and longer. now I would think this would be illegal for them to keep holding her taxes from her and her family for all this time its almost half the year gone by and she is still being told to wait, how can she fight this to get what she is owed this is hurting her kids more than anything by not giving them money for school and expenses to get by on. please let me know cause it saddens me how the government can be allowed to get away with this sort of thing when a child depends on it.

Hi Dustin,

I’m so sorry to hear that this is occurring. Unfortunately once a return is submitted to the IRS, it is in their hands. However, you may want to contact your local IRS Advocate office. Once on the website, choose your state and contact the office that is provided. This office is contacted with any on-going issues with the IRS. They will hopefully be able to help out.

I filed my taxes in may I have yet to receive my refund

Hi Caniyah,

I suggest taking a look at the IRS’ “Where’s My Refund” tool. This should provide you with an accurate date as to when you will receive your refund.