Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

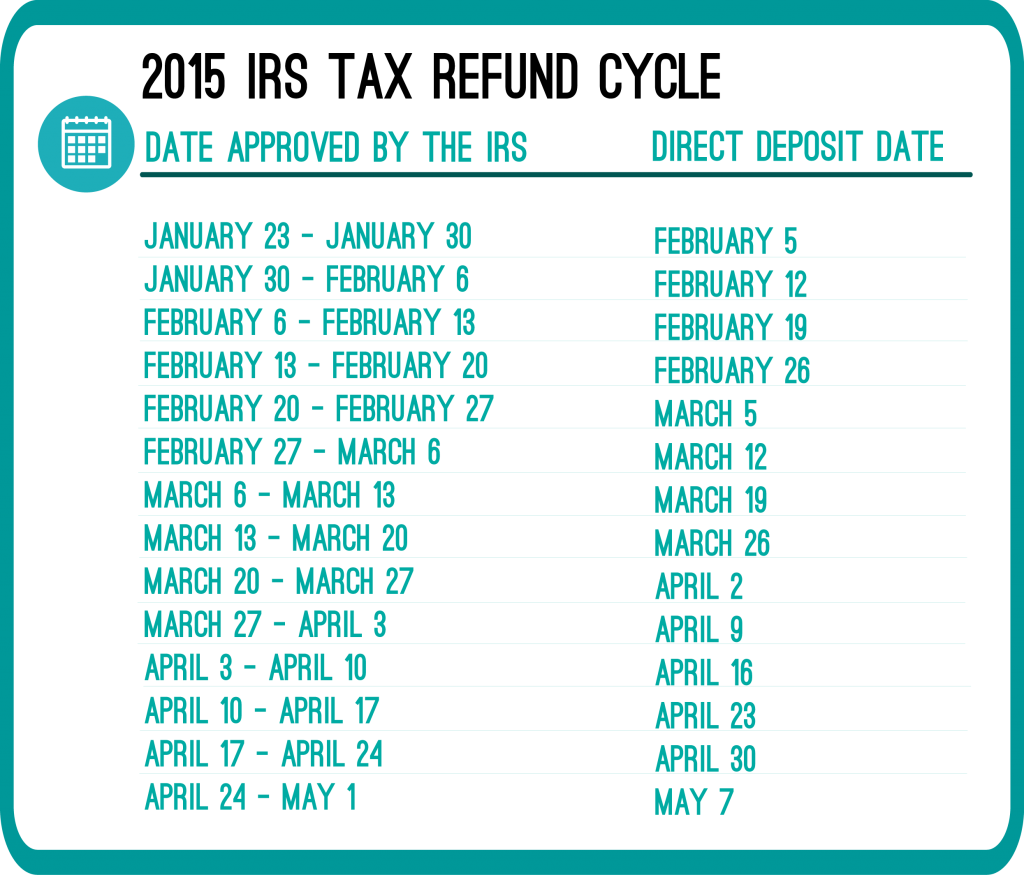

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

Ii filed mines jan 27th of this year then receive a letter stating they need more proof that my son stay with me so I did its almost Aug where’s my money….

Hi James,

I suggest taking a look at the IRS “Where’s My Refund” tool. This will give you an accurate idea of when you will be receiving your refund.

Hi,

We filed late this year. My husband mailed the return in on/about the 23rd of June. We are now in week 5 and the WMR website has gone from saying we need to ‘wait 4 weeks to receive an update’ to ‘they are unable to provide us with any information and to check with our tax preparer’.

I have 2 questions:

First, does the exact mailing/postmarked date truly matter in the search of your refund status? e.g. because I have the wrong date entered I won’t be able to receive a status update??

And second, typically, when filing late AND via paper refund, what is the approximate turn-around time to receive direct deposit refunds? And when would you suggest we make a call to the IRS regarding our refund status?

Much thanks in advance for any help you are able to provide!!!!! : )

Hi NortieKeeks,

I suggest calling the IRS Refund Hotline at 800-829-1954. When you call, you will be asked to provide your Social Security Number, filing status, and tax refund amount.

hello what do i do when i have filed my tax return for 2013 in April and received it April 17th and i still have not received my state tax refund! what do i do to find out what happened to that?>

Hi Edna,

I suggest taking a look at the “Where’s My Refund” application provided by the IRS. This will provide you with an accurate date of when you will physically receive your refund.

I had a tax topic152 and went thru examtion process came to a agreement I will receive refund they close case 6/14/2014 so whennnn will I receive a refund I’m in financial hardship my advocate helped me move to the front the line knw is there a way to speed up the money release

Hi Pammy,

Since you have a special circumstance, I suggest using the IRS Get Refund Status Application. You will be asked to enter your SSN, filing status and refund amount so be sure to have these handy. If you feel that the answer you receive is incorrect, I would suggest calling the IRS to speak with someone about your specific situation.

Hi i efiled my 2012 taxes on my 29, 2014. I have not received my refund how much longer do I need to wait to call IRS? So all together i did 2011 on paper, 2012 eflied, and 2013 amended. I know 2011 and 2013 will take longer, but for 2012 it should had been fast.

Hello Omar,

I suggest using the Where’s My Refund application on the IRS website. If you are unable to receive a result from this then I suggest giving the IRS a call to see when you will receive your refund.