Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

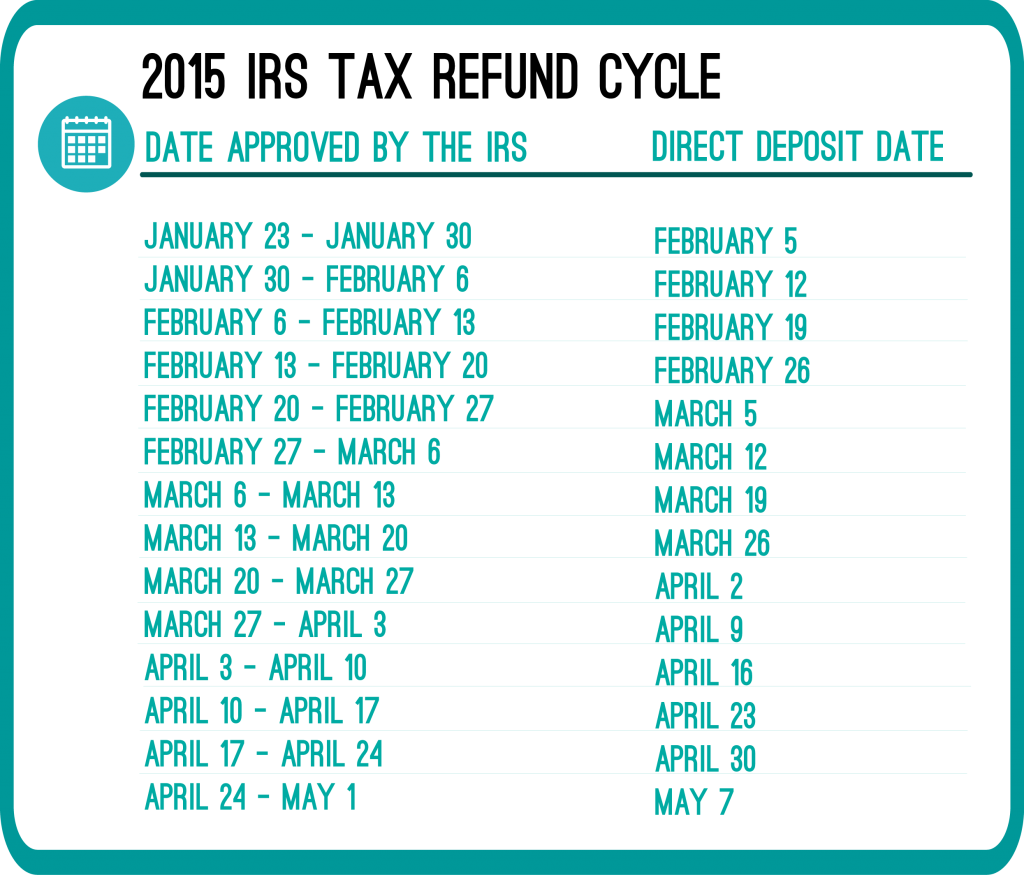

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

Hi i efiled my taxes may 29 and I am waiting for my paper check but when i check where’s my refund on the irs website they do not give me information as to where my refund status is at? how much longer should i wait to call irs?

thank you in advance.

Hi Omar,

If you still have not received your refund and are unable to acquire any information on the IRS website, I suggest giving them a call to get a bit more information of when you will receive your check.

I added an extra called bot was making correction thank you..

filed my taxes on April 5, 2014 on April 6, 2014 jackson hewitt called me ask for my identity thief number same day I called IRS got my identity thief number gave it to Jackson Hewitt still no tax refund I have it going in my daughter bank account… what is the problem? no follow-up call from Jackson Hewitt… come on really? this generation is so unprofessional..

Hi Cheryl,

I am sorry to hear about your difficult/ bad experience with them.

My tax refund was sent to my bank on May 9th 2014 And nothing yet. Please what can i do to get my refund?

Hi Greg,

You should contact the IRS directly, it shouldn’t take that long.

Hello. I mailed my refund on Feb 27. I got back a letter in April saying they needed more papers so I sent in all they asked for on April 3 by certified mail. I received a receipt saying they received it on the 7th of April. I have waited the 21 days to check so I have gone to the wheres my refund and its says they can’t provide any info. I have type in all the correct info, I even called the 1-800 number and it says the same thing. So wheres my refund and who can I call to find out more info on my process?

Hi Linda,

Mailed return can in some cases take up to 8 weeks to process. I would suggest waiting a bit longer, and then contacting the IRS again regarding the status of your refund.