Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

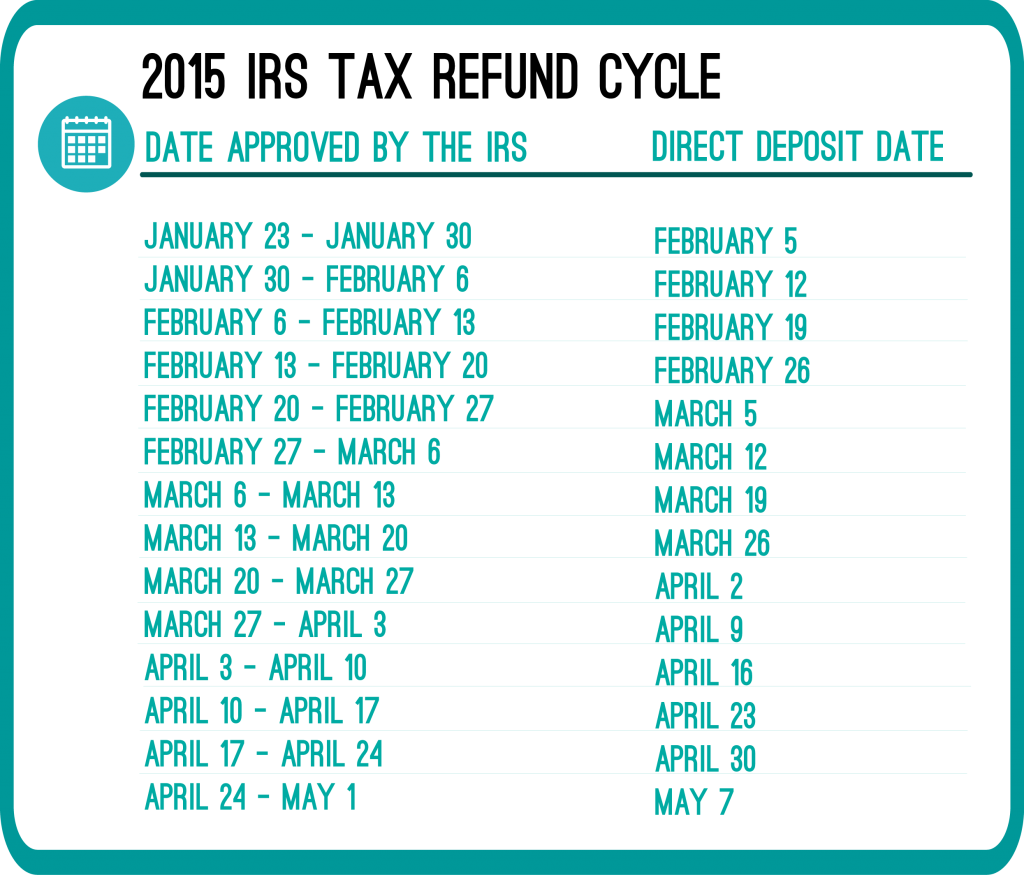

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

Hello. I prepared my taxes through taxact online. Both state and federal were accepted. Federal was approved, processed and received. However my state has only been accepted; not approved or rejected. When I check on taxact it shows absolutely no process nor progress. When I check WMF it says I have entered information incorrectly. I checked all info entered and even checked to make sure I entered it correctly with Taxact and all looks right. I filed on Feb 2, 2014. It’s been much longer than 21 days to process and it still hasn’t been approved or rejected. I’m wondering if there is a number I can call to figure this out. Thank you.

Slight error.. I meant to say I filed on Feb 7, 2014.. not the 2nd.

I went to the IRS building and filed mine on April 15th when can I expect to receive my refund if I had to fill out an Identity Theft Form?

If you filled out an identity theft form, it will take a year to get your refund.

My husband and I filed electronically with injured spouse. After the 11 weeks was up we were transfered to a tax advisor. Because we had cutoff notices and faxed them in our advisor approved us for a hardship case last Monday. On the 23rd she called and said the Irs had finished processing our return and now it just had to go through the computer system to be deposited. That was a week ago. Why have I not gotten our refund yet? How long after the irs finishes processing a return does it usually take for the refund to be direct deposited?

Has anyone received their refund after the 21 days waiting period. The bars has disappeared from WMR site and now its just saying that it is still being processed. If any of you have received their return, how long did you have to wait? Did you have to call the IRS? or did the status just change on WMR?

or is there a number i can reach a real person at tge IRS