Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

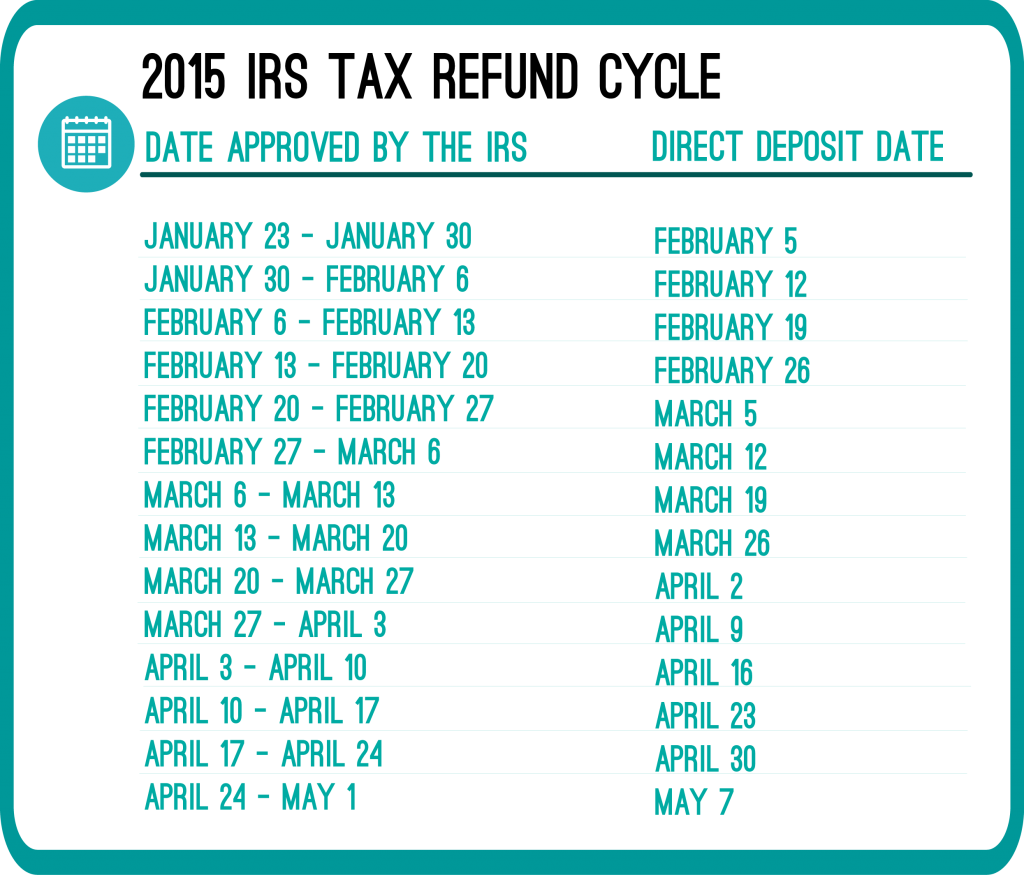

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

Hello my refund was received with you all on. Feb 23. 2014 in it says it’s still being processed on the status can you explain to me why it’s taking so long I still have no received it ?

hi i have my taxes aprooved n it says will hit my bank on april 39th today is april 30th when can i expect them to send it?

Hi my name rashonda I file mind on 4 – 22 – 2014 WHEN WOODED I GOT A REFUND

Hi,

My husband and I filled our taxes the second week in February, the papers were sent out by mail the following week. The IRS probably received it the third week in February. Well still have not received our refund, we check daily on ‘where is my refund’ app and it always says ‘still processing ‘. What is going on? If something was wrong or the IRS needs somethibg, they would have contacted us by now.

Hello, I filed my taxes Feb 7th and was notified by VITA that my eFile had been rejected. I went to VITA and they gave me the paperwork needed to send in by mail. I sent all available paperwork on Feb 17th and waited for my refund. However, on Apr 9th a letter was mailed out asking for more information although I have already mailed all available paperwork. My status still says “processing” and I was wondering as to what should be done? I have already called, however the individuals I have spoken with can only see if my paperwork has been delivered to them. I am trying to get a hold of the individuals actually reviewing my paperwork so I can get a clear understanding of what exactly it is that they need. If by chance you have an email or phone number to this department, please let me know. Thank you.

Hi Michael,

I would expect to receive your refund 6 to 8 weeks after you mailed your return, although if you decided to receive your refund by mail, this could be a bit longer.

Did you file with RapidTax? If so, feel free to call us directly at 877-289-7580 (Monday-Friday 10:00 AM- 5:00 PM) and we would be more than happy to help you with your question.