Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

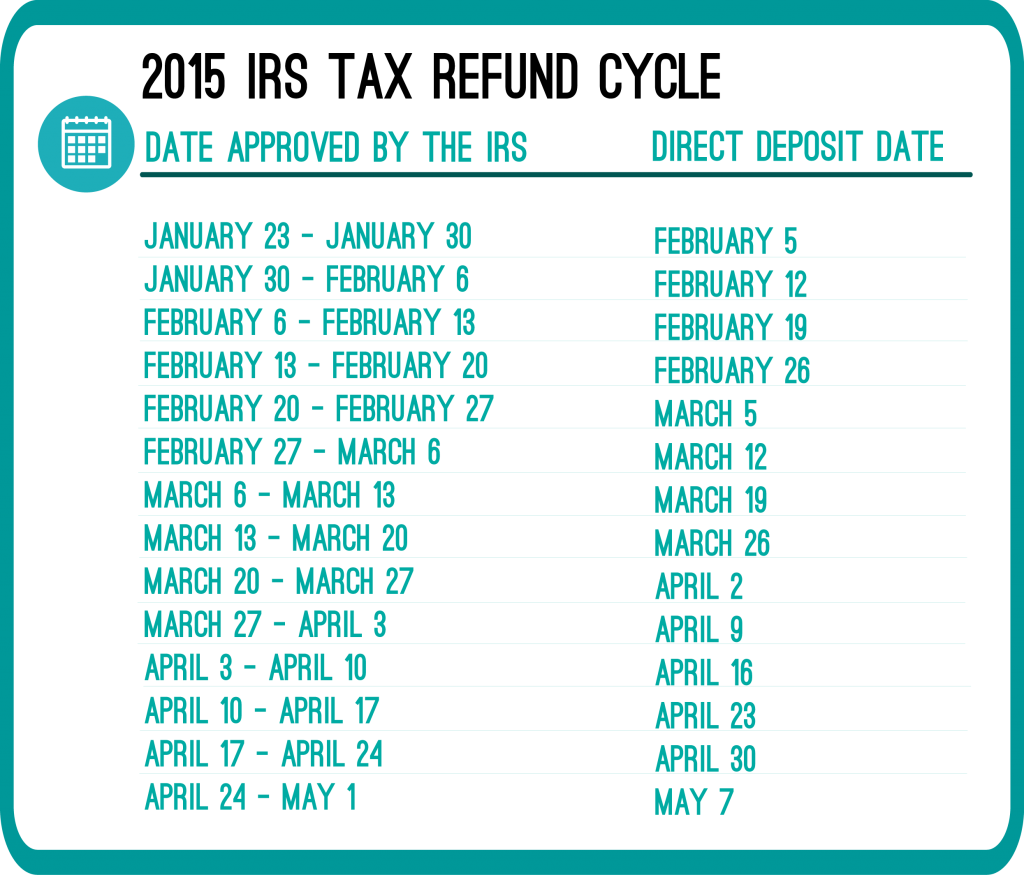

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

my returns was rejected on march 27, and I did do a paper filling around the 2nd of april, when do I expect to get my refund

Hi Jon,

If you paper file, receiving a refund will take between 6 to 8 weeks. I would guess Mid to Late May you would receive your refund.

hello, my husband had filed his taxes through a free tax advisors (AARP) this year. He also chose the Direct Deposit option on the form with using my bank account info. We both wondered where his refund was not deposited into my account after a month and half of waiting. We finally go ahold of my bank and i was told that my husband was “not athourized” to receive any deposits to my account without him signing a form that was required to enable that process. So since we took so long to find the problem IRS declared to send him “a check” instead. We have not received it yet. We also call IRS multiple times since & all they say is “the check has been sent, it may be your post office”. He filed Feb 13,14 & Detected the problem March 5th & was told a new one was sent March 24,14 & we still havent received the check and today is April 21,14. IRS is no help & not sure what to ask our local post office since our other mail seems to be comming regularly with no delay. Do you know if there is a penalty for refund mistakes? or do you have any adivce on how we can locate the check?

Hi Tiffani,

Oh no, that doesn’t sound fun. I am sorry to hear about the problems you had with the refund. I would suggest waiting six to eight weeks from the date they sent it in the mail, if you still do not receive it within that time period, you will need to contact the IRS again regarding the status of the refund. There shouldn’t be any penalty for the confusion with your refund.

Best of luck!

i filied on april 15 th when should i get my refund? do they miss some offset ?

Hi Ed,

Did you e-file or paper file? If you e-filed, you can expect your refund within 21 days of filing. If you paper filed, you can expect your refund within 6 to 8 weeks of filing.

I filed my taxes last year. They went up for teveiw. I had to send in proof documents and still have not received a refund. All i keep receiveing letters. Saying i should get a reply by the datr they give me. Date come around and nothing. Then here comes another reply date. This has been the 5th or6 letter. But no refund. This the 1st time i ever been threw this. Should i still exspected a refund? Its saying have not proccess no information can be found. A while back the bar should process. Then that went away.Help please

Hi Sherri,

I would definitely contact the IRS by phone about this issue. It seems like your tax return went into further review.

Hi tax advisor I was audited in feb I send in all documents on March 28 then received two letters one saying they got them and another saying ill have a response by may 14 why so long I did my taxes with rapid tax

Hi Diane,

If audited, there is a delay in the tax return process and considering the IRS is in their busy season, this all takes a while. It also takes a while because everything is mailed.

We (RapidTax) have no control over individuals getting audited by the IRS and also do not have control over the speed at which the IRS processes your information. If you have any questions at all, feel free to contact us directly by phone at 877-289-7580 and we would be more than happy to help you.

Thanks for filing with us.

Does ordering a return transcript means you will be getting your refund soon?? And if so how long after ordering your transcript do you get a deposit date