Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

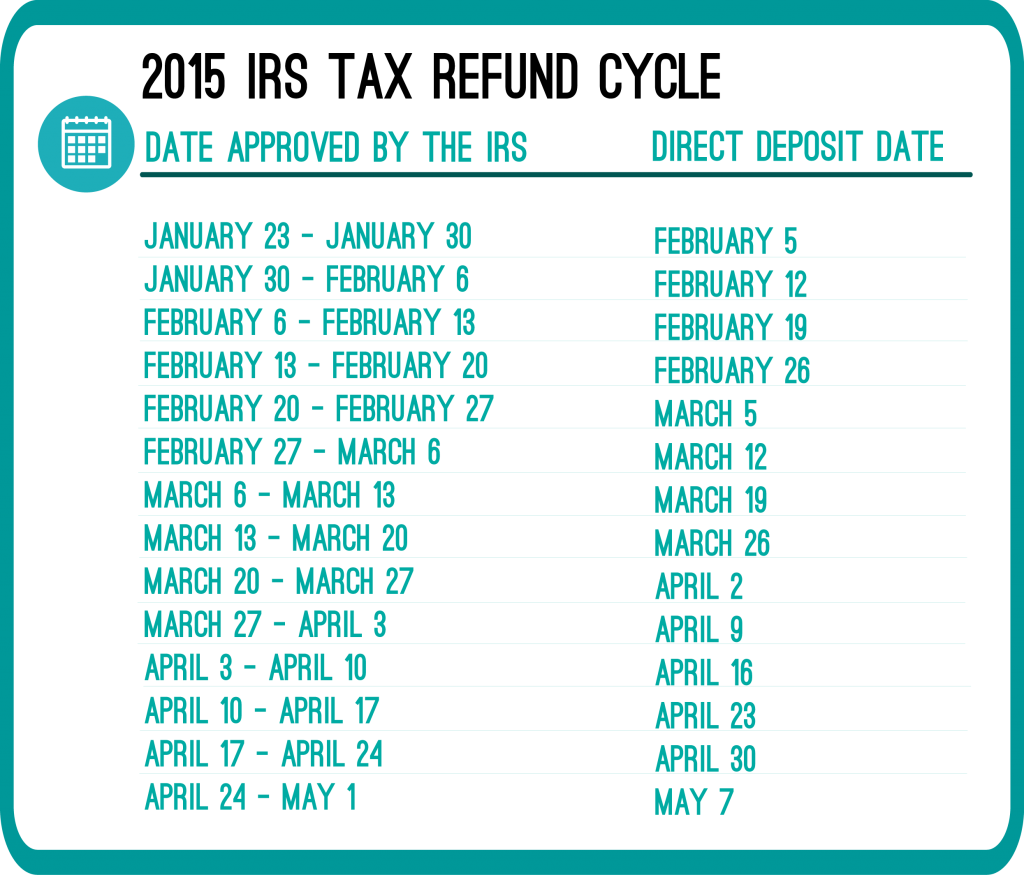

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

Wmr says they mailed my check our on Feb 10 its gonna be march 10 and i still haven’t received my check whats going on

Wmr say my check was mailed on feb10,ita already gonna be march 10 one month and i still haven’t received my check

I filed 01-31-2014. IRS accepted it 02-01-2014. The IRS website is saying refund still processing and a date will be provided when available. I called IRS 03-04-2014 and the rep said since I am a first time tax filer, she could not tell me anything b/c they have no info on me…. I mean really!!!! I thought that was why I have a ss number, so they could pull up info on me and about me, This really sucks! I bet if I owed THEM money, they wouldn’t have no problem finding my info.

Hi Brittany,

I am sorry to hear about your IRS frustrations. I am hoping everything worked out by now. If not, I highly suggest contacting whoever prepared your taxes for you. If it was us, please feel free to call us directly Mon-Fri between 10 AM and 5 PM EST at 877-289-7580, or you can live-chat between 2 and 6 PM EST.

Hi,

I filed on Feb 9, it was accepted the same day. The 21 days went by with no DD so I called yesterday and talked to the irs, They said there was an error with my return ( not paying the $500.00 first time home buyers credit back). But I actually did have it listed on the return. So she said they fixed the error on feb 24 and now it could take up to 6 weeks to receive my refund….. Is this true? Do you know anything else about how long it will take to get them?

Thank you for your help.

Patrick

Hi Patrick,

That sounds about right. Fixing errors can take up to several weeks (as they told you). The good news is that the error has been fixed and that you will be receiving a refund.

How do it figure out if I applied for direct deposit because I don’t remember putting in my bank information but it says that the refund will be credited to my account someone please help.

Hi Ashleigh,

You can ask whoever filed your taxes for you, they will know. If you filed with RapidTax, on your downloaded return (which is available on your account status page under the download tab) you can read through it and on the second page of your 1040, you can see if you opted to have your refund direct deposited.

On the second page of the 1040, one of two things will appear meaning you decided to have your refund direct deposited;

1. The direct deposit routing and account number for your refund.

2. The words “fee collect” and “applied for” in the routing number and account number boxes. This means you decided to have your refund direct deposited but had the fees of the tax filing service first deducted from your refund.

The second page of your 1040 return will not have any information listed in the banking number boxes if you had your refund sent to you by check in the mail.