Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

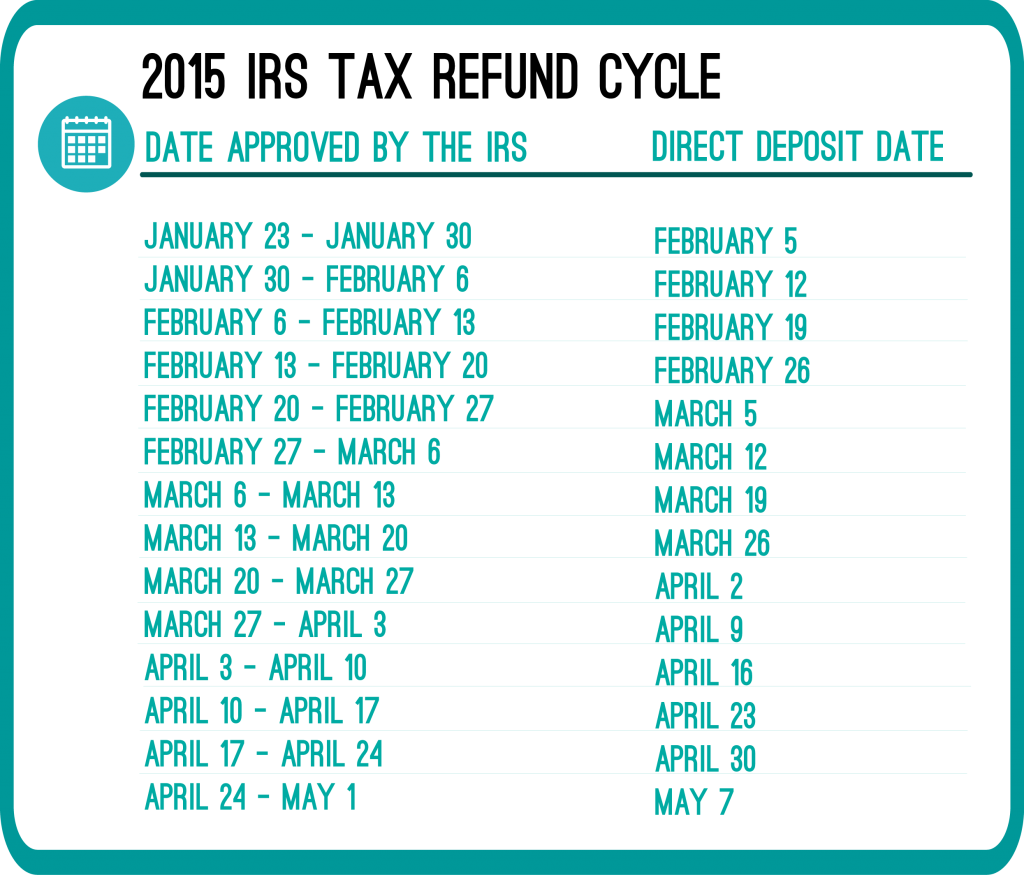

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

i filed on 2/8 been checking WMR today I check my account transcript and it read as follows

cycle date 20140805

150 Taxes filled 3/10

806 with holding 4/15

766 credit 4/15

768 EIC 4/15

846 refund issued 3/10

what does all this mean will I get my refund on 3/10

I filed my taxs on january 17 it got accepted january 31 today is the febuary 21 and no refund it says still processing from january 31 can u ppls tell me what happening

HI Steve,

If your status has not changed, I suggest contacting the IRS directly at 1-800-829-1040 if you would like an IRS representative to research the status of your return. (Just a heads up, the phone lines are extremely busy so you may have to wait on the phone for an extensive time.)

I sumbitted my refund on the 1/31/14 and git one bar that was recieved following day….been processi.g for 21 days called irs and still couldnt tell me anything..as of 2/20/14….any ideas? Wmt site says still processing

I filed on the 27th of Jan the lady put in a wrong ssn and now its saying they need additional information will I at leaat get part of my refund

Hi Danesha,

Mistakes happen and sometimes individuals enter the wrong information. You will still get your refund if the information has been corrected.

Hello.. I did my income tax February 8th I paid extra to get it in 2 weeks. My question is when I go to where is my refund it tells me it can’t provide any information about my refund? I called my tax preparer and they said it was sent and accepted. Last year when I filed my income tax I did it on January 31 and didn’t receive it until first week of May. I don’t understand why ? But I guess it’s going to be the same thing this year? And done people that did theirs before me got it in like 7 days or 14 .

Hi Cindy,

If you are filing with the same company or tax preparer for the second year in a row, and it takes an extremely long time each time, I would suggest changing companies when filing your next taxes. Also, if there is no update on your refund information on the IRS website, they may have no of filed your return yet. I would contact the IRS directly by phone, to ask.

If you decide to file with us in the future, it’s good to know, the RapidTax team works to make sure your return is submitted to the IRS as soon as possible. Although the IRS can take longer than expected to file some returns, we generally see customers receive their tax refund within 21 days after filing with us.