Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

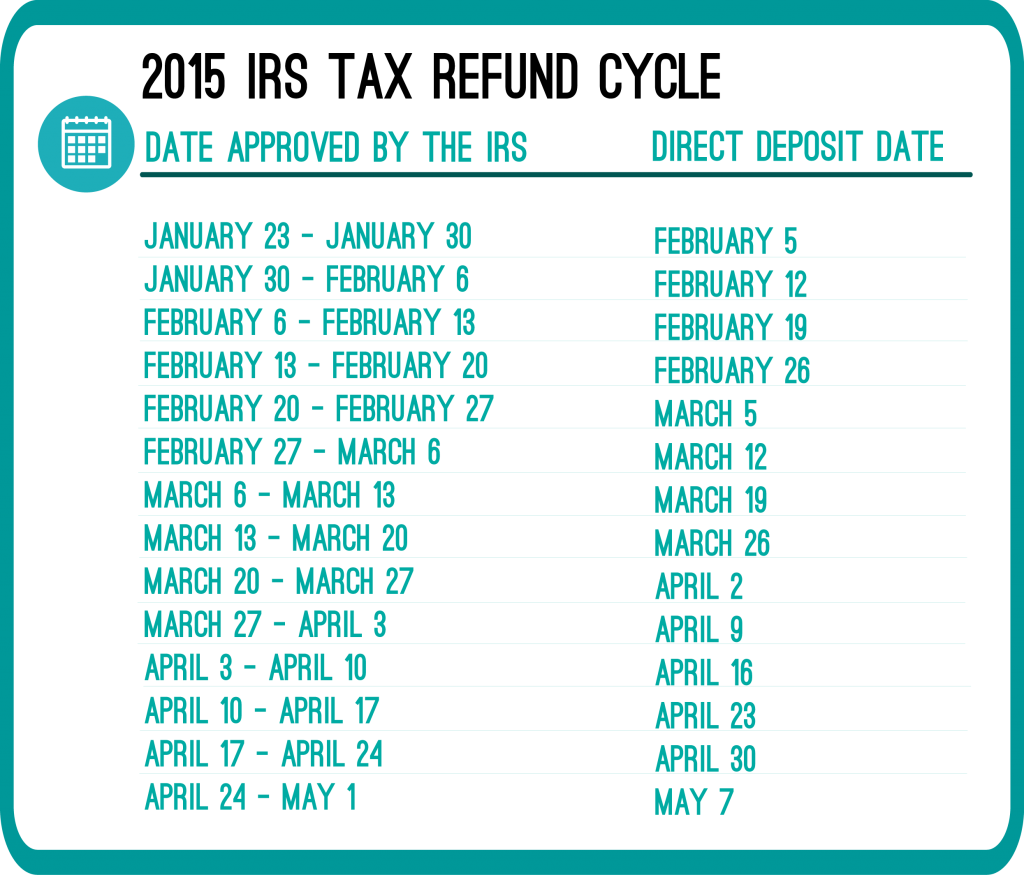

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

Mine is still processing I filed on 27 jan 2014 what’s going on

Hi “Yep”,

The IRS can take longer than accepted to file returns in some cases. If the 21 days has passed and you still have not received any updates regarding your status, I would suggest contacting the IRS directly, by phone.

We filed our taxes on feb.6. Went on irs websire where is my refund.. said it was accepted same day with like 8 days said it was approved and said our scedule date for refund date is the 20th. Tomorrow (: into our bank. So if I recieve it ill let you all know.

How long can it take for irs to accept my tax return..I efile on 2-13 and was rejected for wrong ssn. So my tax place resubmitted on 2-16. Does it take this long to be accepted. On the Web site it says 24 to 48 hours.

Hi Juan,

I wouldn’t include the 16th and 17th in the 24 to 48 hours processing time because the 16th was a Sunday and the 17th was a holiday (President’s Day). I would expect to see an update by tomorrow. If nothing changes, contact whoever you filed your return with to make sure it was re-submitted.

If you filed with us, you can contact us directly at 877-289-7580 Monday-Friday 10:00 AM- 5:00 PM and we can give you an update on the status of your return.

I was accepted on 2/24/14 and I was checking wmr like crazy its about 5 days an my bars are gone have a msg about its being processing wit code 152 my 21 days wud b up Thursday shud I b worried

Hi,

I am guessing you meant to type you were accepted on 1/24/2014, rather than 2/24/14?

Topic 152 just means your tax return is in progress. Once it’s processed, the status will change to approved and an estimate date of when you’ll receive your refund will appear. I wouldn’t worry until 21 days has passed. Once 21 days has passed and if there are no changes, I would contact the IRS by phone.

Hi, so is it 21 business days or calender days?

I filed on the 30 of January and was reject it but resubmitted and the 31 got accepted and now it just shows that is being processed should I worry ?

Hi,

No, I wouldn’t worry until 21 business days pass. Once these 21 days pass and if there is still no status change, you can contact the IRS to learn what is going on with your return.