Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

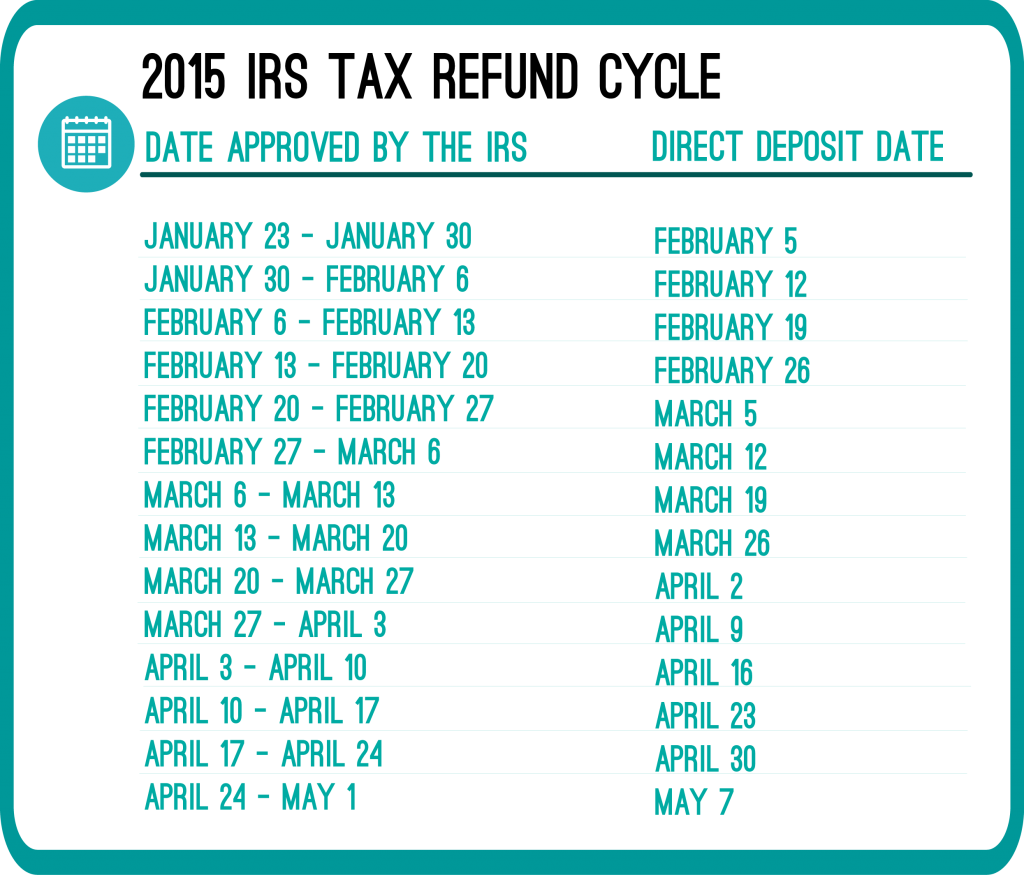

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

How accurate is your DD date from the Irs is your money is being direct deposited to a ny get it card tax card?

Hi,

The refund cycle chart on this post is only an estimate based on previous year IRS trends.

Ok my return got accepted on feb 6 Ii am still at one bar and it tells me about tax topic 152 anyone having this issue if so please explain,,,

Hi Ericka,

Topic 152 just means your tax return is in progress. Once it’s processed, the status will change to approved and an estimate date of when you’ll receive your refund will appear.

I wouldn’t worry until 21 days has passed. Once 21 days has passed and if there are no changes, I would contact the IRS by phone.

ok thanks I dont see no code or nothing just been stuck there for days..

Yes i got accepted feb 2 an my 21 days will be on feb 22 but when i check my refund status im still on the first bar what should i do

Hi Tony,

I would wait until the 21 days has passed. If at that point you do not have any updates, I would contact the IRS directly by phone and let them know of your situation.

I filed february 3 and was accepted on the 7 and my date was 12. I want to know when will i get my refund in the mail.It says that my refund was mailed out on the 12th. How long does it take to recieve it in the mail.

Hi Mia,

It’s good to know that if you elected to receive your refund check by mail, it can take several weeks. For future reference, electing to receive your refund by direct deposit will allow you to receive your refund more quickly, between 1 and 5 days.

I feel into the early acceptance group. Was given a dd 2/13 on 2/12 i got a 1121 code checked my transcript refund cancelled on 2/3 now it has a processed date 3/3 please help. Im not understanding

Hi Nicole,

There are many tax-filers who have reported seeing the 1121 code on their refund status. The 1121 code traditionally doesn’t mean there is a problem, but could be due to a number of issues, which explains the delay in your refund date.