Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

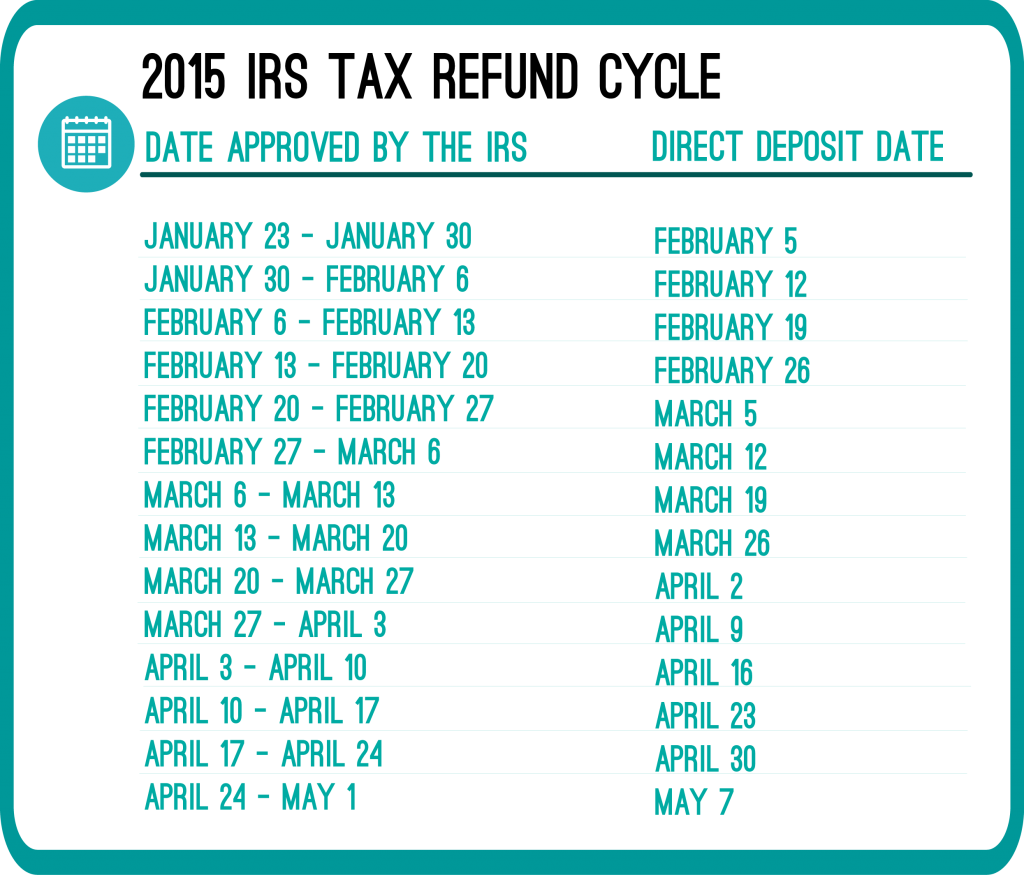

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

I filed my taxes on Jan 21 I was rejected bc my child SSN was incorrect so I took her off my taxes it accepted my taxes on the 31st would that affect my return..I went thru the accepted part with bars now I don’t have any bars. What does that mean?

Also I received my state on 02/10/14 wasn’t even expecting it….:)

I filed injured spouse feb31 and its still saying being processed. And will give me a date when available should I be worried

Hi Patty,

I am guessing you meant to type Feb 3 or Jan 31 instead of “feb31”? Either way, you can contact the IRS directly at 1-800-829-1040 and learn the updated status of your return.

Hi Patty. It can take up to 14 weeks for an Injured Spouse case to be finished. Last year it was longer for some of us. This year it seems like they have been getting most done within 6 weeks or so. There is a great support group on facebook called Injured Spouse Tax Filer Group! it is very informative and the people are great. I would advise that if you want information on Injured Spouse and waiting buddies I would request to be accepted in the group.

Hello, I e-filed my taxes this year and received an email on January 25th that my return had been accepted early by the IRS. I’ve been checking the WMR website daily and it’s still saying it’s being processed (with no status bar). It’s been right at 21 days since it’ s been accepted, is this a sign that something is going wrong? Or when should I look to have my refund sent?

Hi June,

If the WMR still reads that your refund is processing at the end of this week, I would contact the IRS directly, by phone to ask.

I filed my taxes on 1/28 they have been accepted and approved with a ddd of 2/12. According to WMR my refund was dd into my on 2/13 but I haven’t received anything as of yet. I called my bank to see if I had a pending deposit and they told me no. I verified with my bank and tax preparer my account and routing number. I don’t know why it is taking so long or what the problem could be.

Hi Tequila,

It can take around 5 days for the refund to be processed and deposited to the bank account. If it isn’t deposited by the end of the week, I would suggest contacting the IRS directly, by phone.

I filed my taxes on the 28th of Jan and was accepted on the 30th of Jan. Up until yesterday I still had the first bar on my WMR site. I then log on to WMR yesterday and I have the message that says “refund still processing and a date will be provided when available. ” This has never happened before and I still have topic 152 on my screen. Should I be concerned?

Hi there,

No, you shouldn’t be concerned until 21 business days has passed. After 21 days, you can contact the IRS via phone and let them know your status has not been changed and still displays your refund is being processed.