Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

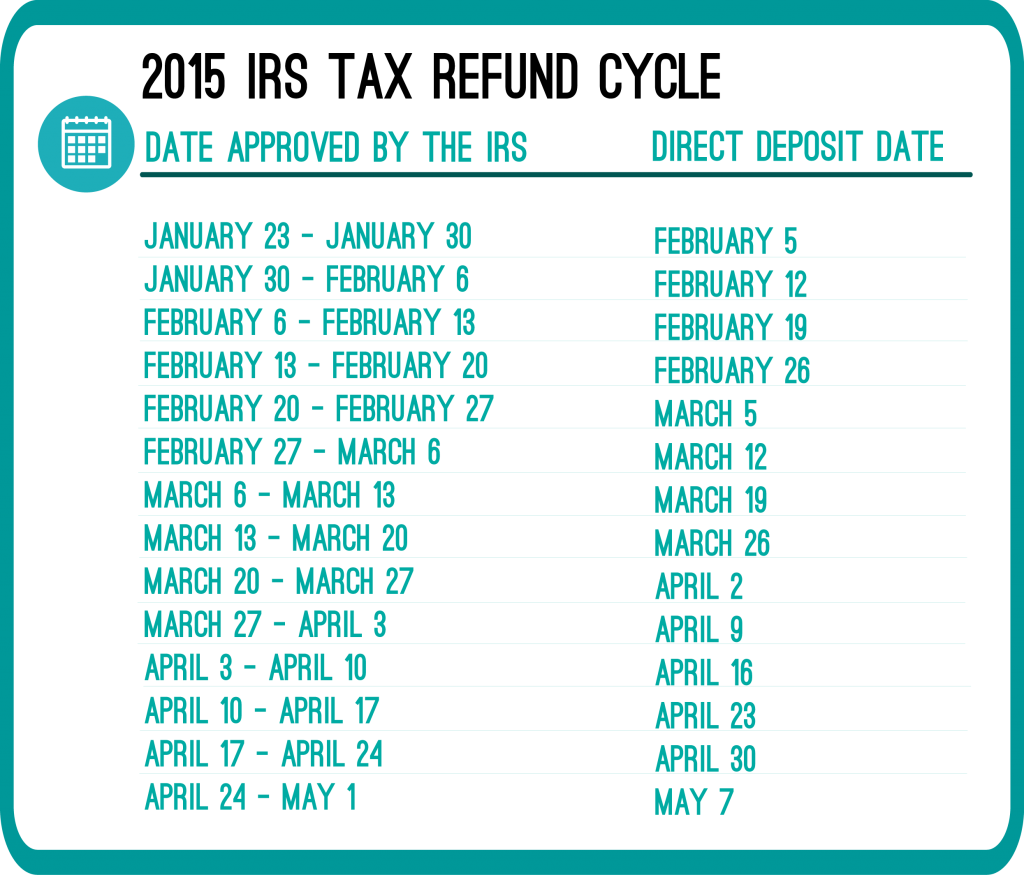

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

IRS accepted on the first of feb n it has been approved why are they say it excepted. To come on the 18 if I have direct deposit. Why so long when me n friends went same day n they have already gotten there’s

Hi Cynthia,

The IRS does not process all returns in the same amount of time. Some receive their refunds faster than others. The IRS only has stated that 9 out of 10 refunds will be processed within 21 days.

Has anyone gotten a refund back yet?

I got a text from H&R block saying the Irs has accepted my return Feb 4th and I check Where’s my refund and there’s hasn’t been a change and it will not give me a date…

Hi Rachael,

I would check with H&R Block and ask them about this, they might be able to explain what is going on with your tax return.

Really? If your tax return was accepted 02/04/2014 but your status has not changed from accepted to approved its a concern? I really need to know

Hi Karen,

As long as 21 days has not passed, then you are probably fine. Although it can be frustrating to wait and see no changes in your status, it’s good to know that your return was accepted. Having a refund approved status can happen quickly for some, and take much longer for others. I would wait the 21 days and if nothing changes, contact the IRS.

My refund was supposed to be sent to my bank today according to wheres my refund but i have nothing pending at my bank and went through turbo tax i know i entered everything correctly could they just be running a day behind

Hi Helen,

Although we are not TurboTax, I do know that banks or financial institutions may take 1-5 days to deposit the tax refund into your account.

We actually have an article titled “What Does My Tax Refund Status Mean?“, which explains this.

Best of luck!

I filed Jan 31st and it said received on the irs page I am still waiting to be approved I don’t understand whats going on it never takes this long. Should I be worried I know I put the wrong bank account number on it

Hi Jess,

If you think you put the wrong bank account information, you can check with whomever you filed your return with to make sure the information you entered is correct. Regardless, it can take up to 21 days. With that said, as long as the IRS website is displaying your return was received, that’s what matters most right now.

It’s frustrating when you need the refund and it’s taking longer than expected, however, the IRS has only stated that 9 out of 10 tax-filers will receive their refund within 21 days.