Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

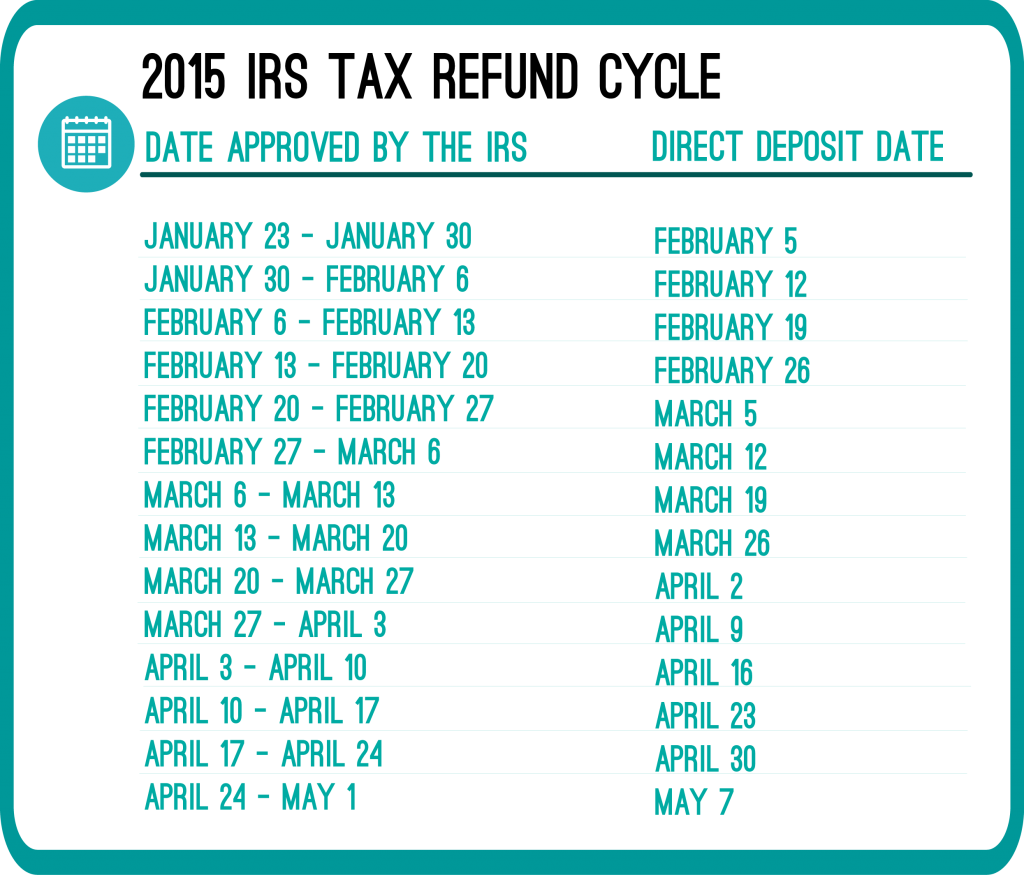

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

Hello…. We filed on February 4, had the “return received” on 2/5, and “refund approved” on 2/7…. It’s telling us that our refund should be DD by February 13th….

Last year it wasn’t like this, we waited over a month and a half!! It was a pain!

Hi there,

A month and a half… that’s not fun! Just like last year, you should not plan on receiving your refund on exactly the date displayed on WMR. Why? Well, it takes both the IRS and banks time to process your refund and have the money deposited into your account and available to you.

I would expect to receive your refund sometime at the start of next week, if you haven’t received it already.

Ok I filed on 28 of jan excepted 29 of jan and still saying processing I have no hard stuff no house nothing like that no school loans so

what is the problem here I file 1040ez simple form whats the hold now my dad alot of crap on his did them same day as mine got his back already

Hi Alvin,

The IRS refund processing can take longer for some. There is no exact reason. If you don’t receive an updated status after 21 business days from the date you filed, I would suggest calling the IRS.

How will u kno if anything Is wrong with your tax refund? Will where’s my refund tell you if there is an error in your refund ?

Hi Monique,

If there is an error with your return, it will take the IRS much longer than 21 days to process your return. With that said, once it has been more than 21 days since you filed, you should contact the IRS by phone (800-829-1954) to learn the status of your refund and if there are any errors.

Filed taxes on 30th with Rapid Tax… Tax preparer said I should get refund on feb14…but go to the Irs website and it say received but still processing called RT yesterday and she said everything was fine but was also told that Irs don’t give dates out……Can you get your refund without a date being shown??????..Totally confused…Please help

Hi Tin,

Thanks for filing with us! February 14 is an estimate date. With the IRS there is no exact date you will definitely receive your refund. If the IRS website says the return is processing that is a good sign and means your return was received by the IRS.

The status of your return is “return received” when processing. The next status will be “return approved” which means your refund is all set and is being prepared to be sent to your bank (or by mail). Then, the last status is “refund sent” meaning your refund was sent out and a date will be provided. In many cases, the date does not appear until after the refund was sent.

filed on the 5th of feb was told by preparer all filed that day would be bk by the 12th is this true?

Hi Felicia,

It can be. However, there is no promised date when it comes to the IRS processing refunds. However, you should receive your refund within 21 days of filing.