Once upon a time, there was an IRS refund cycle chart that told taxpayers when they could expect to receive their tax refund.

Don’t plan on the IRS posting a 2015 Refund Cycle Chart. In 2012, the refund cycle chart fairy tale ended and the IRS eliminated the chart.

However, there are still helpful tools out there to help filers get an idea on when they can expect to receive their tax refund in 2015. Since each year differs slightly, you can check out the 2016 refund cycle dates HERE.

Where do I go to find out when I will receive my refund?

The IRS no longer posts a tax refund chart, however, they did post an article last year explaining a refund tool available on their website called “Where’s My Refund?”. Once your 2014 tax return is filed, you can check your refund status on the IRS site. You’ll need to enter the following information;

- social security number

- filing status

- refund amount.

Are there any estimated refund cycle charts available?

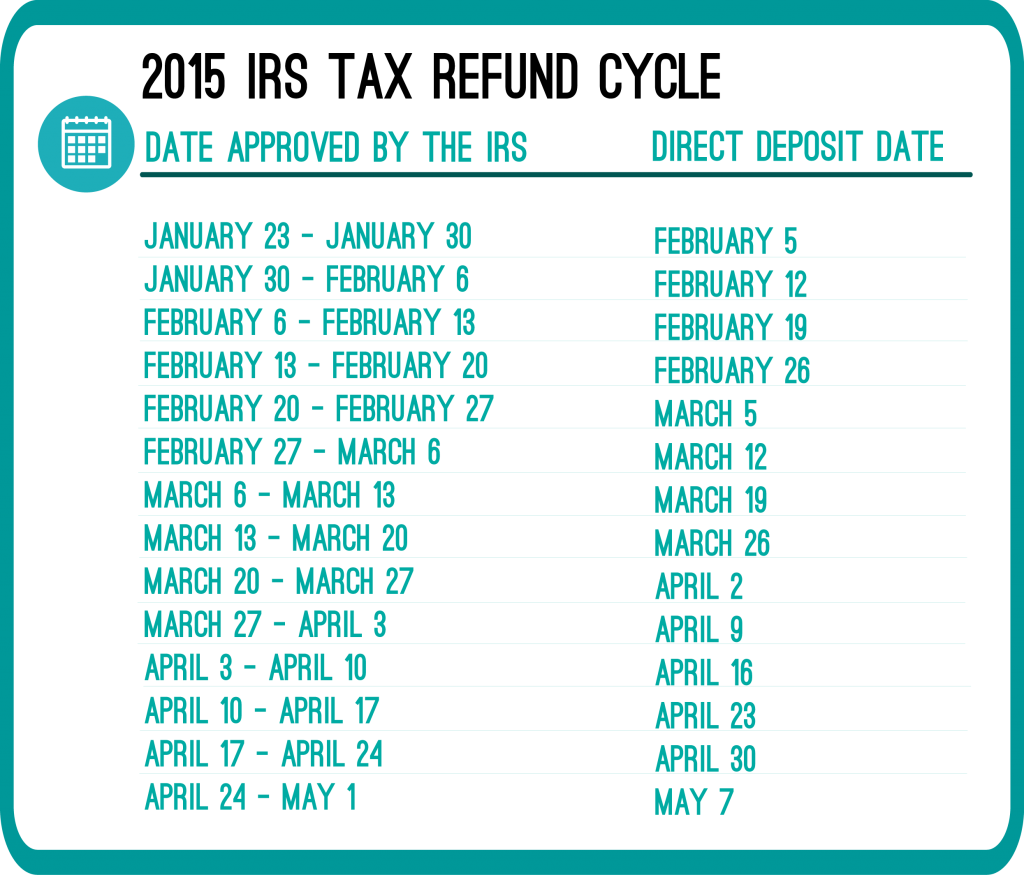

Although the IRS won’t post a 2015 refund cycle chart, there are estimate refund cycle charts out there. The dates are based on trends from prior years. The tax refund cycle chart is based upon how you elected to receive your tax refund; via direct deposit or check. Below is an example of a 2015 refund cycle chart (don’t forget these are estimate dates);

The tax refund cycle dates are NOT promised dates. They are simply dates based off of previous year trends. To know for sure when you will receive your taxes, wait a few days after filing your 2014 taxes, then check the IRS website using their “Where’s My Refund” tool.

The IRS is now accepting e-filed 2014 Tax Returns. That means you can file your 2014 today with RapidTax and within 21 days you’ll have your refund money. | Photo via Seth Anderson on Flickr

So I filed my tax on January 25 it was accepted that day and I got a approved date saying it should be deposited into my acct by February 10th ?.. I have not received it yet and my friend filed her 3 days later than me but received her refund on the 10th of February! How is that fair?

Hi Jules,

When choosing direct deposit to receive your tax refund, you also want to keep in mind that the timing will depend on your banking institution. If the IRS deposited your refund on February 10th, it could take a few additional business days for your bank to clear the amount. If you contact your bank, they should have an idea how long this takes to clear.

Today is 02-10-2016 which is my DDD date, I yet have received my refund and am concerned on the delay, yet no one can tell me what is going on, should i be concerned.

Hi Becky,

The direct deposit date that the IRS provides you with does not include your bank institution clearing time. If you still have not received your refund, give your bank a call to see how long it typically takes them to clear tax refunds.