If you e-filed your tax return this month, you are probably wondering the status of your tax refund.

Perhaps you are constantly checking your bank account balance, hoping your tax refund has been deposited into your account. Instead, maybe you’be been running to your mailbox looking for your refund check.

Whatever your case may be, it’s good to know that it generally takes the IRS 21 days to process tax refunds. RapidTax is here to help you track down your tax refund. If you haven’t filed your 2013 yet, you can create an account and file your late 2013 tax return now and within 21 days you’ll have your tax refund.

I Waited Until April to File, When Will I Receive my Federal Tax Refund?

It’s good to know, if you filed your tax return in April, it will most likely take the IRS a longer period of time to process your refund compared to someone who e-filed in Mid- February or March.

Why? Well the IRS receives a large quantity of tax returns in April. That means, thanks to so many procrastinators, the IRS has a large bunch of returns to process in the month of April, which means it’s not as easy for them to process refunds super quick.

In other words, it’s best to file mid-season. However, if you didn’t file early on in the tax season and instead, waited until April, it’s okay (hey, at least you filed before April 15th). The IRS states that 9 out of 10 refunds will be processed within 21 days. That’s 21 calendar days. So if you filed on the deadline, April 15, then you should expect your refund around May 6.

I Filed My Tax Return more than 21 Days Ago and Still Haven’t Received my Tax Refund

Depending on how you filed your taxes, will determine the length of time it takes the IRS to process your tax refund.

- If You Paper Filed: If you paper filed your tax return, you shouldn’t expect to see your refund before 6 to 8 weeks from when you filed. Paper filing is a much longer process for the IRS to process tax refunds than e-filing.

- If You E-filed: If you e-filed your return more than 21 days ago and still are waiting for your refund to be deposited into your account, then you should contact the IRS by phone at 1-800-829-1040. An IRS representative to research the status of your return.

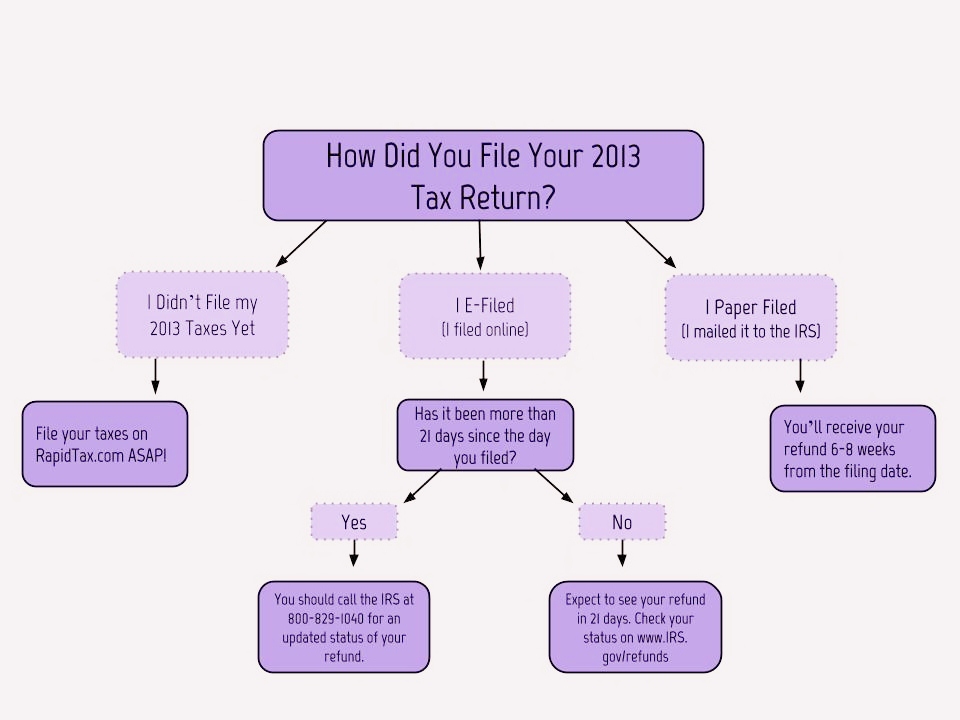

Use this chart to help you track your 2013 tax refund:

Nervous that there’s something wrong with your tax return? If the IRS needs more information regarding your tax return in order to process your refund, they will contact you by mail. Also, keep an eye on the IRS “Where’s My Refund” tool.

If you e-filed your return, you can expect to see it within 21 calendar days. If you paper filed, you’ll have to wait 6 to 8 days to receive your refund.

If you haven’t even filed your taxes yet, you should do so sooner rather than later. In fact, you can do so right now on RapidTax. Within 10 minutes, you can have your return prepared to be submitted to the IRS. Then, within 3 weeks you can expect to see your tax refund.

4/25/2014 Photo via Gagan Sadana