History tends to repeat itself.

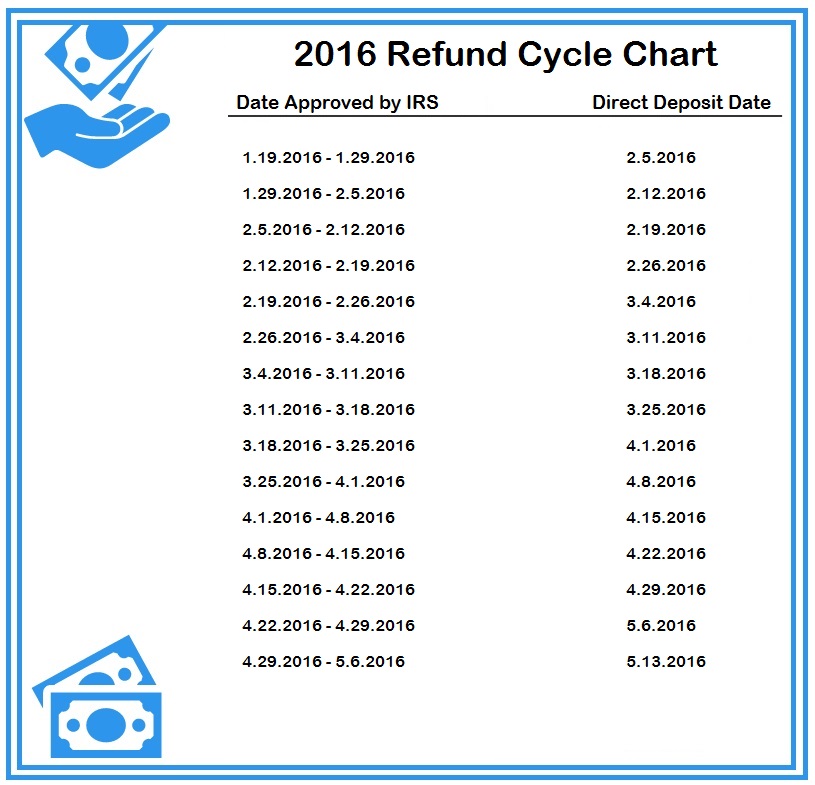

We get it. To avoid false promises and tied up phone lines, the IRS stopped posting a refund cycle chart in 2012. Although the IRS won’t post a refund cycle chart anymore, that doesn’t mean that we can’t do a bit of research to estimate the dates that our refunds will arrive in our bank accounts.

Whether you want to book a getaway with that special someone (…or your buddies), need to pay those bills that are piling up, or just have a firm grasp on your finances, knowing when you’ll be receiving such a large chunk of money is important. That’s why our team at Rapidtax has put together a 2016 refund cycle chart for you based on prior year trends.

Is there another way to check a tax return status after filing?

Yes. There is an alternative that can give you a bit more accuracy. The IRS provides taxpayers with the “Where’s My Refund?” tool on their website. Upon filing your tax return for the current year, you can check back to the site for a status update. In order to take advantage of this, you’ll need the following information:

- your social security number

- your filing status

- your expected refund amount

One of the few downsides of this tool is that you can only check the status of your most current year filed tax return. So if you were playing catch-up this year and filed your returns dating back from 2011, you’ll only be able to check the status of the most recent year that you filed.

Prepare your return online and get your refund ASAP.

At Rapidtax, we know that getting your refund as fast as you can say “TRIP TO TAHITI” is important. That’s why we offer the best customer support with our team of tax pros ready to assist you while you prepare your return online.The official start of the tax season is January 19th but you’ll be able to create an account with us before then and contact our team with any tax questions you have.

I filed and accepted January 19th and still have not received my refund 24 days later. Irs rep says its still processing. when should I see my refund?

Hi Brooke,

Most refunds are received within 21 days. The best thing for you to do is check back to the Where’s My Refund tool on the IRS website. This tool is updated daily with your refund status. Once it is finished processing, you will receive a date in which your refund will either be mailed out or direct deposited into your bank account (depending on what you chose when filing). Since the IRS insists that they will research where your refund is in the filing process after 21 days, I highly suggest giving them a call next week if you still have not received an update.

Hey Brooke I filed on the 28th just checked WMR website mine finally updated gave me a DDD of the 18th think they must be behind processing check the website now it maybe updated

Ok I should have gotten mine yesterday…and its still not in ???

Hi Jesse,

As stated in the article, these dates are approximate. The IRS no longer provides a refund cycle chart of their own, however, prior year trends tend to continue in current years. You’ll want to keep an eye on the IRS Where’s My Refund tool on their website as well. They update this tool daily.

My 2016 refund was accepted January 27th. Today, February 5th, “Where’s My Refund” continues to say that it’s being processed. Although the “Refund Cycle Chart” says I should get a direct deposit today. What’s going on here?

Hi Tonia,

I understand that it can be frustrating waiting on your tax refund. As stated in the article above, these dates are estimated based on prior year trends. Unfortunately, the IRS no longer provides specific dates promising when they will be direct depositing taxpayer refunds. Although it helps to refer back to the estimated refund cycle chart, you should also keep an eye on the IRS Where’s My Refund tool. It is updated daily to reflect where your return is in the process of e-filing. Once they have processed your return and approved it, the IRS will then provide you with a date for direct deposit.

I was accepted on 1/27 as well and still show processing

Hi Lindsey,

As I mentioned to Tonia, it can be frustrating but the IRS gives a 21 day threshold before they will research into the where-abouts of your tax return. If 21 days has passed and you still have not received an update on the Where’s My Refund tool, contact the IRS directly. Choose option 2 when you call in; not the refund info option which will direct you to another automated system.

Filed my taxes on Jan 21 was received on the 23rd today on Feb 6 it says approved two bars and a deposit day of Feb 10..this is the longest I’ve ever waited for refund!!!

I’m one of the few that filed early, 1/20/16, it was accepted the 22nd and then nothing else has ever been updated. Does that mean since my “where’s my refund” bar has never been updated, that I will have to wait til the 2/12/16 or even later?

Hi Sunnie,

Keep in mind that, as stated in the article, these refund cycle dates are estimated based on prior year trends. Although the dates provide a pretty good idea of when the IRS will deposit your refund into your bank account, they are still only approximate. Check the IRS Where’s My Refund tool for updates specific to your tax return. This tool is updated daily.

Beginning 2017, the IRS must hold the refunds of filers claiming Earned Income Tax Credit or Additional Child Tax Credit until February 15, according to the IRS web site. Don’t know if this applies to anyone inquiring here, but it is worth a mention, in my opinion.

I just want to know if direct deposits happen on Fridays? I was told only Wednesday and my due date says the 5th which is Friday.do they deposit all week? Someone please help.

Hi John,

Typically, the IRS will direct deposit tax refunds each Friday of the tax season. This is based on past year trends since the IRS no longer discloses specific refund schedules. You can take a look at our schedule in the article above. Please keep in mind that although the IRS direct deposits your refund into your bank account, the banking institution has policies that may prolong the clearance of your refund amount.