It is difficult to stay updated on state tax changes. The Tax Foundation states that 39 states will implement tax changes in 2025, including individual income tax cuts in nine states. Staying informed about these changes, especially if you reside in one of the affected states, can be crucial strategies for maximizing your tax return for 2025.

For example, consider the impact of the Tax Cuts and Jobs Act (TCJA) expirations in 2025. The Tax Foundation emphasizes that policymakers will be navigating the expirations of certain provisions of the TCJA in 2025. A Tax Foundation calculator can help you understand how these expirations might affect your personal tax situation. This analysis could reveal potential areas to focus on to maximize your tax return.

3 Best Strategies to maximize your tax return for 2025:

Maximize retirement account contributions.

Retirement plans are a key area for tax deductions. The IRS offers various tax-advantaged retirement plans, and the sources list several types, including IRA accounts, Roth IRA accounts, and 401(k) rollover options. Maximizing contributions to these retirement accounts can lower your taxable income and increase your tax return.

- Contribute to traditional IRAs and 401(k)s up to allowed limits

- For 2025, you can contribute up to $23,000 to a 401(k) if under age 50

- If over 50, you can make additional catch-up contributions

- Traditional IRA and 401(k) contributions reduce your taxable income dollar-for-dollar

To maximize your 2025 tax return through retirement account contributions, focus on fully funding both your employer-sponsored 401(k) and an Individual Retirement Account (IRA). The key is contributing pre-tax dollars, which directly reduces your taxable income. For 2025, you can contribute up to $23,000 to your 401(k), and if your employer offers matching retirement contributions, make sure to contribute at least enough to get the full match – this is essentially free money. Additionally, you can contribute $7,000 or less to a traditional IRA, and if you’re 50 or older, you can make extra catch-up contributions of $7,500 to your 401(k) and $1,000 to your IRA. These retirement contributions not only lower your taxable income dollar-for-dollar but also grow tax-deferred until retirement. For example, if you’re in the 24% tax bracket and contribute the full $23,000 to your 401(k), you could reduce your tax bill by $5,520. Remember that the ability to deduct traditional IRA retirement contributions may be limited if you or your spouse are covered by a retirement plan at work and your income exceeds certain levels, so consult with a tax professional about your situation.

Take Advantage of 2025 Tax Deductions and Tax Credits.

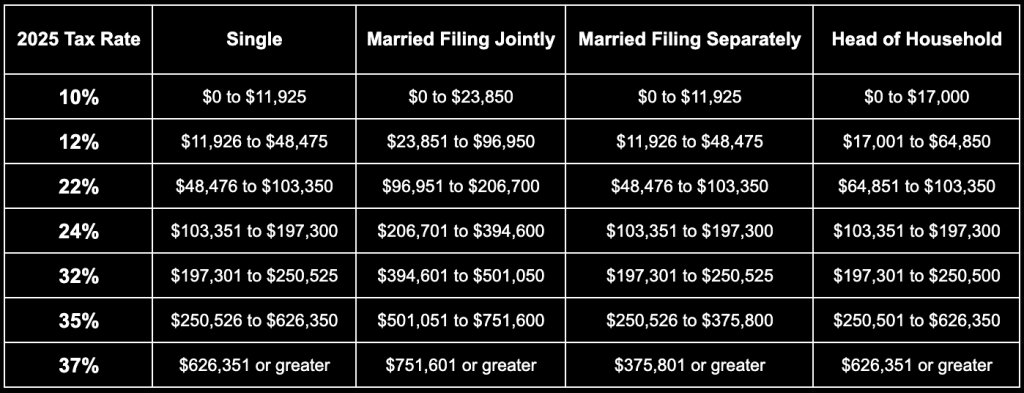

Utilize available 2025 tax deductions. The standard tax deductions for 2025, indicating that maximizing deductions is crucial. While specific deductions aren’t detailed, this highlights the importance of exploring all applicable deductions to reduce your taxable income.

Some 2025 Tax Strategies Can Be

- Bundle multiple years of charitable donations into a single tax year

- Keep records of business expenses if self-employed

- Look into tax credits for energy-efficient home improvements

- Consider contributing to an HSA (Health Savings Account) if you have a qualifying high-deductible health plan

- Track education expenses for potential education credits

Optimize your filing status and timing of income/expenses

Consider the timing of major purchases or sales to optimize deductions. If married, calculate whether filing jointly or separately is more advantageous. Plan end-of-year income and deductions strategically. Keep detailed records of all potentially deductible expenses throughout the year.

Remember that tax laws can change, so you should verify with a free and dedicated RapidTax tax professional or the IRS website. Our dedicated tax professional can also help identify additional strategies based on your specific financial situation.